The History of West Falls – Part 2. The Challenges of Negotiating a Public-Private Partnership (2018 to 2022 and ongoing …)

Summary

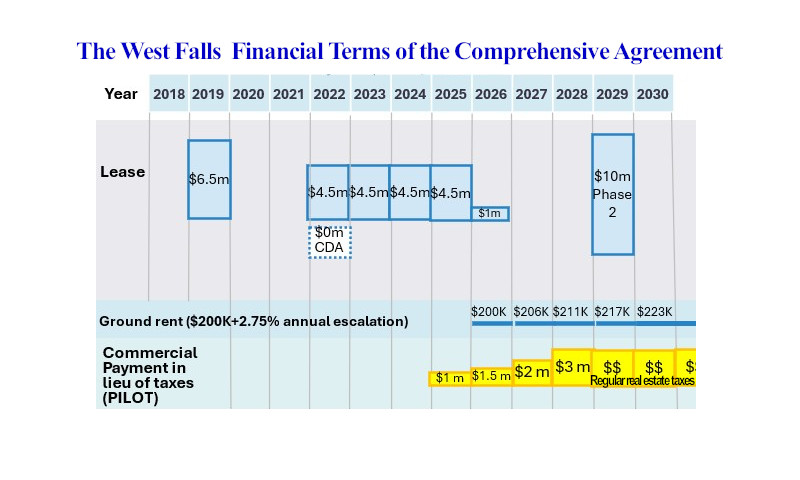

- In December 2018, the initial agreed value of the land lease of the 10-acre West Falls site was $44.5 million; $34.5 million would be paid in the first five years of Phase 1, and $10 million for Phase 2 by 2029. But when COVID hit in 2020, Falls Church Gateway Partners (FCGP), asked for a further $10 million reduction in the Phase 1 payments, citing higher construction costs and the need to achieve an 18% project rate of return to attract financing. A ground rent of $200,000, escalating 2% a year, begins in 2025.

- FCGP negotiated a real estate tax payment plan called PILOT in the Comprehensive Agreement (CA) that caps taxes at a total of $7.5 million until 2029. Then, the full tax collection is estimated to have a net fiscal impact of $3-4 million annually.

- Another perk the City had to give up was a 0.5% fee on any leasehold components that changed ownership over the 99-year period, called the capital event fee. FCGP also withdrew its offer to pay the City $2-3 million to set up a Community Development Authority.

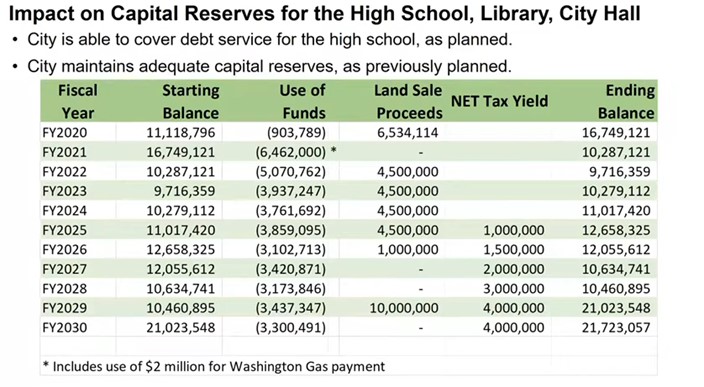

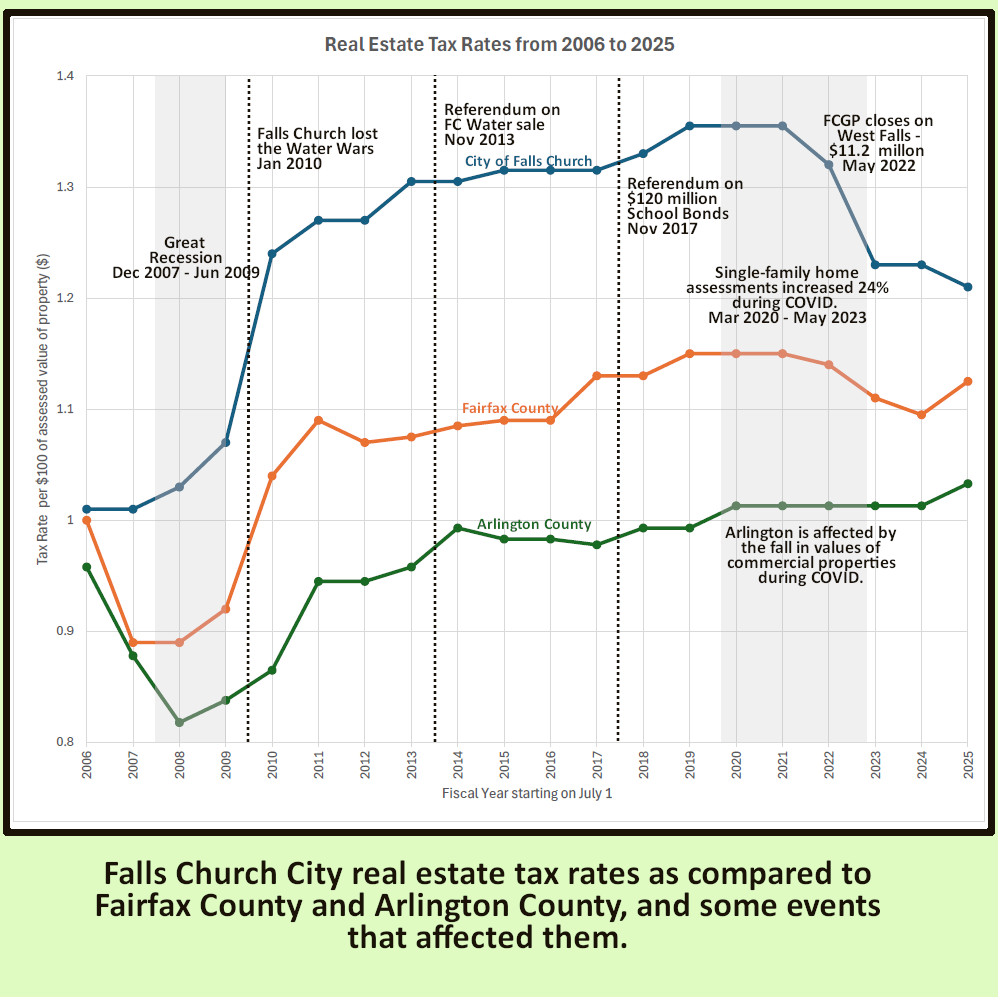

- In the FY2022 Budget Report, City Manager Wyatt Shields stated that the City had raised real estate taxes and 8.5 cents of the tax rate was earmarked for the school bonds debt service. The City planned that lease payments and tax yields from West Falls ultimately would help avoid additional tax increases.

- Two successive partners in the Senior Living component of the project withdrew. This component was removed from Phase 1 and called Phase 1b in the agreement. A third partner was found.

- After repeated delays, FCGP Phase 1 finally closed in May 2022, with the developers taking possession of the site and starting the clock on land lease payments. FCGP was renamed to become WF Developer, LLC. The Senior Living component, Phase 1B, recently delayed its closing by one month to November 30, 2024.

Background

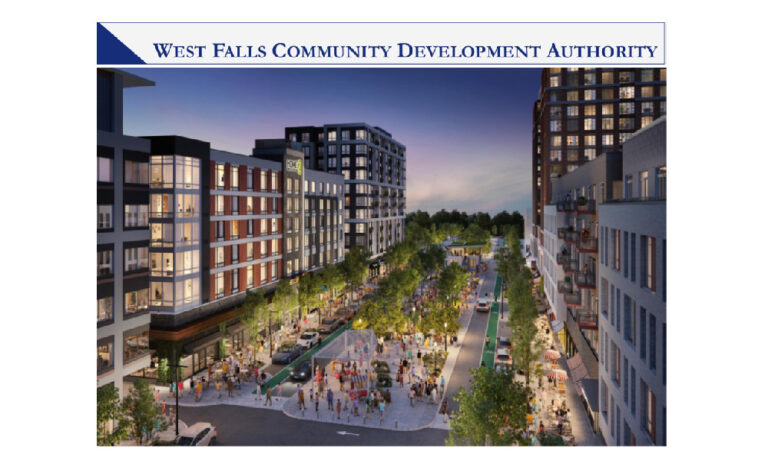

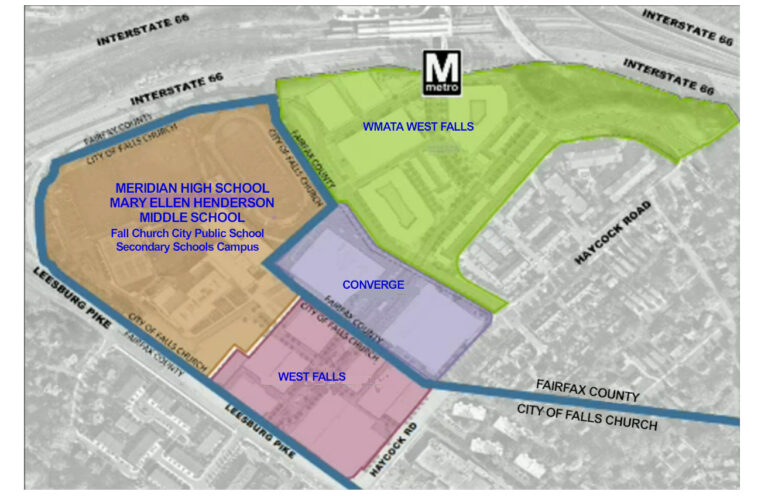

In Part 1 of the history of West Falls, we wrote about the City’s strategy to enter into a public-private partnership with a developer to lease and develop the 10-acre West Falls site, using the lease payments and tax revenues from that venture to help pay the debt service for the school bonds issued to build the new high school. According to this plan, taxpayers would shoulder the debt service until the West Falls development began generating funds. This debt placed the City at a disadvantage in negotiations because of the urgent need for funds to relieve the burden on taxpayers. The City needed to seal a deal as soon as possible.

The search for a commercial partner ended with the selection of Falls Church Gateway Partners (FCGP). In this post we look at the negotiations between the City and FCGP on the terms of this partnership over a multi-year period. These negotiations involved the financial terms of the lease and the responsibilities of both parties (the Comprehensive Agreement) as well as the rudimentary site plan that would provide some specifications for the buildings and the voluntary concessions (the Special Exception Entitlement). This post focuses primarily on the financial agreements in the Comprehensive Agreement.

These negotiations and re-negotiations were carried out in closed sessions and settled before they were presented to the public. The financial documents were kept and remain confidential; only the final agreed-upon terms were presented to the public. City staff and Council members that we spoke to told us the negotiations were difficult and time-consuming.

Without knowledge of the starting point of each negotiation and who asked for what, it is difficult to assess the results. The developer initiated each amendment. If it involved a financial issue, it resulted in less upfront money to the City. The developer’s goal of maximizing the project’s return for themselves and their investors was often at the expense of the City.

Negotiating the Comprehensive Agreement (CA)

The Interim Agreement (IA) – December 2018

The Interim Agreement (IA) formed the basis for negotiating the final Comprehensive Agreement (CA) that would specify the development’s financial terms, each party’s responsibilities, and the delivery requirements. This IA included the major aspects of the detailed design proposal submitted by FCGP and specified a six-month negotiation period ending with a signed CA.

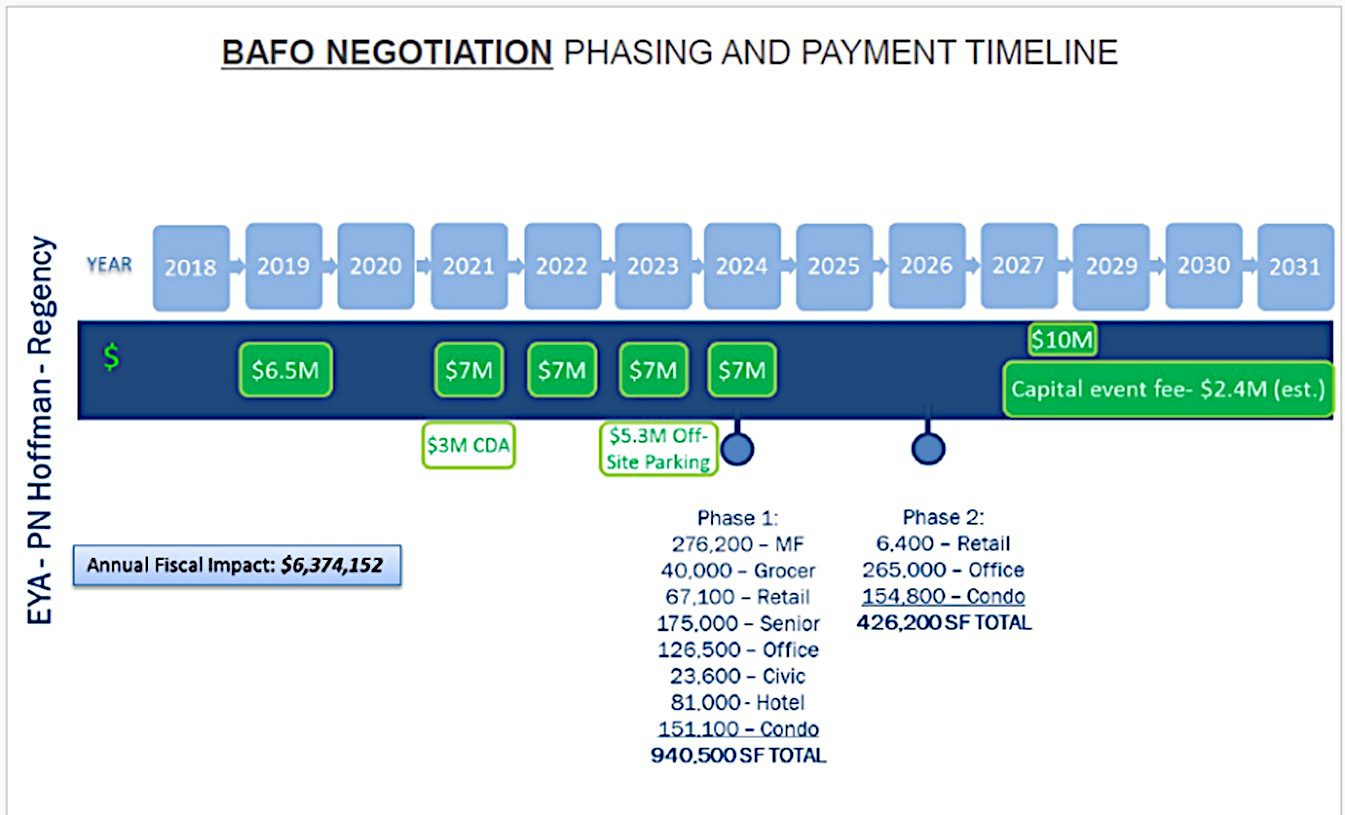

The City would lease the land for the commercial buildings to FCGP for 99 years. The land for the condominiums would be sold. The parties agreed to a payment schedule, as shown.

a. Land Lease – $44.5 million

The land lease and sale were valued at $44.5 million. FCGP would pay that in six payments. The first five payments totaling $34.5 million were for Phase 1. The remaining $10 million for Phase 2 could increase following an appraisal at the outset of Phase 2. These “upfront” payments would help cover the debt service until the development started paying taxes.

The first payment of $6.5 million would occur when the Special Exception Entitlement (SEE) was executed. The SEE was a preliminary site plan that also specified voluntary concessions, such as affordable housing units and financial contributions to the parks, libraries, bikeshare, etc. It was expected to be approved together with the CA. The next four payments of $7 million would start on Closing Day when the 10-acre site was handed over to FCGP. FCGP agreed to demolish the existing George Mason High School building at their expense. The Phase 2 payment would be made on its closing date.

The closing of Phase 1 was agreed to be in 2021. Phase 2 closing was scheduled for June 2, 2026, but FCGP could apply for three yearly extensions. FCGP would pay a non-refundable fee of $800,000 for each extension, that would be applied to the final lease payment.

b. Capital event fee

In the event that the leasehold property is sold or refinanced, the City would be entitled to a capital event fee of 0.5% of the value transferred. For condominiums, this fee would be 0.25%. For the leasehold property, this was estimated to be $2.4 million.

c. Additional payment opportunities

FCGP would pay the City an additional $2-3 million to provide moral backing for bonds issued by a Community Development Authority (CDA), if a CDA were set up to raise funds for infrastructure costs. (A CDA is a government entity that can issue bonds for the benefit of a community and levy taxes or a special assessment on the community to repay the debt.)

If a shared parking garage were built on the adjacent school parking lot, FCGP would pay $4.1-5.3 million to share the parking with the schools. (This option was included in the SEE.)

d. Other commitments in the Interim Agreement

- Provide rent subsidy for civic uses.

- Include hotel brands .

- Make the office building is part of Phase 1.

- Require a grocer of at least 20,000 sq ft or an alternative tenant that offers the fiscal impact of the planned grocer.

- Specify 625,000 in gross square footage of commercial and residential buildings.

- Include 6% affordable housing units or cash in lieu.

- Regarding sustainability, meet LEED Gold construction standards, except for the hotel, which will be LEED Silver.

The project was estimated to be substantially completed in two years, by 2023 or 2024, when the City would expect the tax yield to start, i.e. real estate taxes due. City staff estimated that a completed Phase 1 would be valued at $380 million and would generate over $5 million in taxes at the 2018 $1.33 tax rate. The net fiscal impact would be about $4.4 million.

Council discussion

At its November 19, 2018 meeting, the City Council voted (6-1) to enter into the Interim Agreement, or IA, with FCGP. Council Member David Snyder was the sole vote against doing so, protesting the lack of public involvement and a fundamental financial structure of the chosen proposal that he indicated would generate only one-third the amount of money by the year 2021 compared to the alternative proposal. The financial details of the two proposals were not – and still have not – been made public.

“My overriding concern is to generate the money we need for our school,” Mr. Snyder said, asking that more of the uncertainty and the possible downsides of the financing be reflected in the proposal and how such challenges might be managed.

While Mayor David Tarter and Council Members Letty Hardi, Ross Litkenhous, and Marybeth Connelly were unreserved in their praise of the approved proposal, Council Members Phil Duncan and Dan Sze pressed the developers for more.

Stating that he liked the proposal because in November 2018 “this deal has no City money in it” and is “a genuine mixed-use development,” Mr. Duncan urged that there be a greater percentage of affordable/workforce housing and suggested that if the City were willing to give the developers more building height, the City might get other things it wants, such as more open space. He hoped the architecture at one of the entrances to the City “will be distinctively Falls Church” and expressed a desire to bring along the 36% of voters who opposed the school bond referendum.

While he said, “This team represents our best chance for success,” Mr. Sze urged the developers to achieve better than LEED Silver for the hotel, calling environmental sustainability “future proofing.”

The City held a town hall on December 16, 2018, where FCGP presented their proposal, and City Manager Wyatt Shields shared the initial financial details in the IA with the public for the first time.

Interim Agreement Amendment: the PILOT – February 2019

FCGP returned to the City two months later to request changes to the IA citing “financeability” as the reason. FCGP wanted:

- To increase the residential density by 150,000 sq ft (50,000 sq ft Senior Housing and 100,000 sq ft in condos or apartments) for a total of 775,000 gross square footage of commercial and residential buildings, and

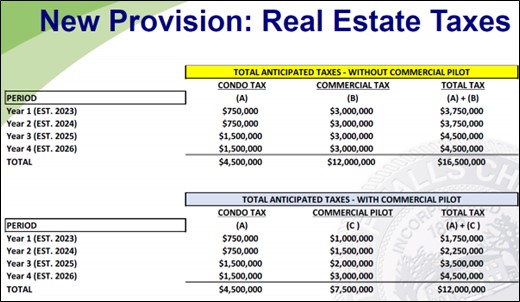

- To cap real estate taxes for four years through payments in lieu of real estate taxes (PILOT) for the leased commercial parcels only (not the condominiums). The project is not expected to yield any taxes for the first two years of construction. The caps, starting at $1 million, are shown in the table below.

In return, the City would get:

- $200,000 in annual ground rent starting from 2029 through the end of the 99-year lease, increasing by 2% each year.

- 0.25% on condo first sales as a capital event fee (previously, only post-initial sales).

- 25% of any increase in land value over base land value on Closing Day. This is the “land lift” part of the deal.

For the City, while the taxes may not be as high those early years, it takes away the possibility of costly challenges to its assessments of partially filled properties. It also incentivizes the developer to complete construction and fill the buildings as soon as possible to take advantage of the lower taxes during those six years.

Council Member Ross Litkenhous commented on this change at the February 11, 2019, City Council meeting, saying, “I certainly agree with a number of folks who look at the upfront payment as the most important aspect. I, for one, like to find a balance. I’m actually in favor of an annuity of payments for the City. I think it behooves us as a City to put in place mechanisms that live beyond this initial phase of this project…”

The IA becomes the CA – May 2019

The terms of the amended Interim Agreement were put into the Comprehensive Agreement and signed in May 2019. However, the SEE was not settled until July 2019, and this settlement omitted the shared garage payment option. The City received $6.5 million from FCGP, the first lease payment.

The City issued $119 million of school bonds four months later. Debt service in the FY2021 financial report increased by $6 million from the FY2020.

The COVID pandemic cuts $10 million from the project – 1st CA amendment, January 2021

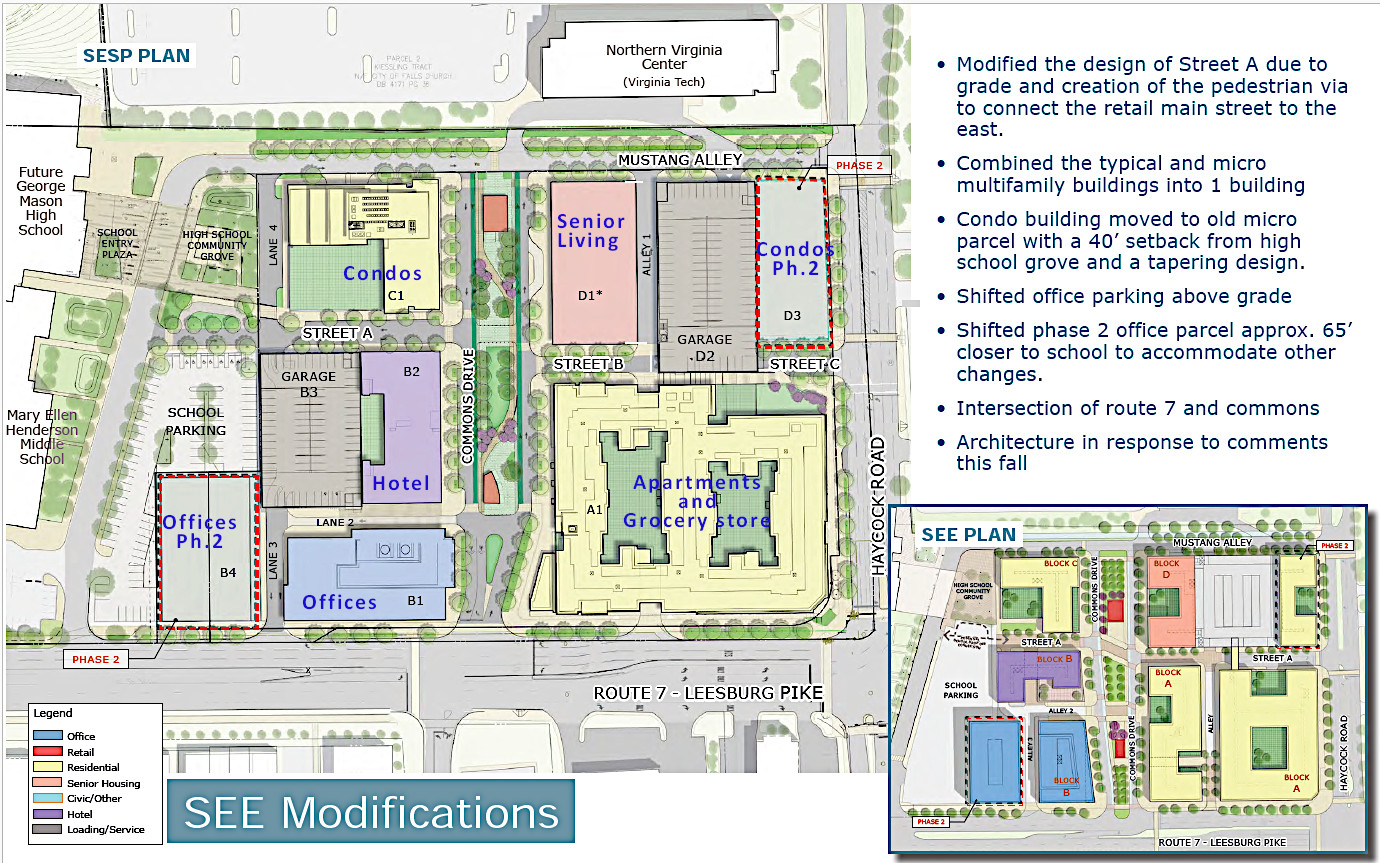

The West Falls project did not escape the economic turmoil and supply chain shortages wrought by the COVID pandemic that began in March 2020. By July 2020, FCGP revised their plans to build underground parking, citing a 50% increase in costs. Instead, an additional above-ground parking garage was added to the plan, requiring another 0.33 acres of land. The Phase 2 office building (B4) now sat entirely in the school parking lot.

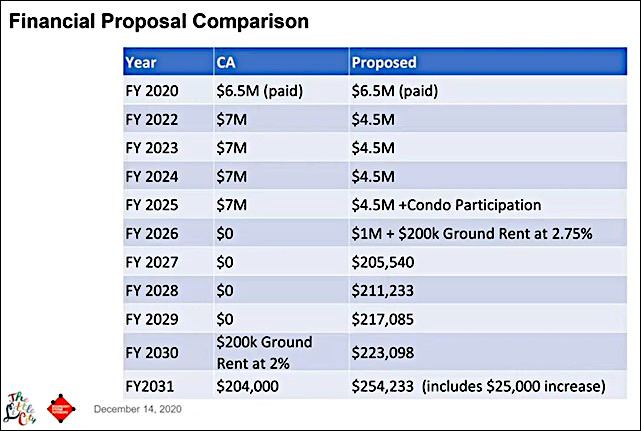

In an increasingly bleak national economic environment, the City engaged in tense negotiations with FCGP over a reduction in the land lease from $34.5 million to $25.5 million. The remaining four capitalized lease payments would go from $7 million to $4.5 million, followed by a fifth $1 million payment, and other concessions. The developers argued that the market value had fallen while the construction costs had increased significantly. FCGP said they would not be able to get the project financed otherwise and threatened to claim a “force majeure” to suspend discussions and payments.

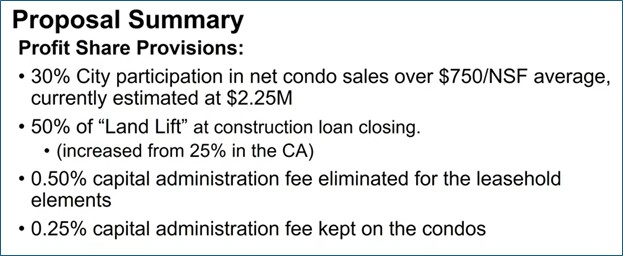

FCGP also removed the capital event administrative fee for the leasehold elements, worth over $2 million. FCGP proposed to compensate the City by starting the ground rent payments in 2025 (vs. 2029) with an annual escalation of 2.75% (vs. 2%). A $25,000 increase would be added in 2031. There were other changes to the profit sharing provisions, as shown below.

The City is required to set up a CDA to raise infrastructure funds

The developer is responsible for the infrastructure (sewer, storm drains, electricity, roads, etc.) within the West Falls site. However, this amendment also required the City to establish a Community Development Authority (CDA) to issue up to $15 million of bonds to pay for the infrastructure but would neither require the City to provide “moral backing” for its bonds, nor would FCGP pay the City for such backing as proposed in the IA.

The Closing Day deadline was delayed from end of 2021 to April 30, 2022.

Less money for the City, 18% returns for development investors

At a virtual town hall meeting on December 17, 2020, to present the new amendment to the public, the competing needs of the public-private partnership were clearly on display. Council Member Snyder asked FCGP to explain to the public the expected rate of return that the developers were trying to achieve with this reduction of payments to the City.

FCGP said that when they were “shopping” the project to potential equity partners- typically institutional investors such as large pension funds, the expected rate of return had been 16-18%. With COVID, investors required a higher return.

Robin Bettarel of FCGP said, “We told the City [the rate of return] we needed to get to was 18[%], which is the bottom rung of where we think this is financeable. … I think when we originally signed the IA we were at a 16[%]. Post pandemic and the sort of drops in real estate values that have occurred particularly in the case of retail, we were somewhere around 12[%], and so with this plus a combination of some other things that we did on our side to reconstitute the deal … we gave up a lot of that just to get this done, and to make sure that [the] equity partner is going to get their return…”

Referring to the reduced payments and the need to avoid delays,City Manager Shields said, “We then essentially cover the increase in debt service, which is not currently covered by the tax rates, which all of our residences and businesses currently pay. [The increase] would be covered by these lease payments and then ultimately by the net tax yield from the commercial development once those land sale proceeds cease.” He added, “For the City, the tax yield is very important. A delay to the tax yield is something we have to consider.”

Trouble with the Senior Living component – the 2nd CA amendment, August 2021

The West Falls development included a 14-story senior housing building. The original Senior Living operator withdrew from the project in the summer of 2021. Trammell Crow, which was developing the office building, offered to take over the Senior Housing component, with Perkins Eastman designing the building.

The new design reflected the lessons learned from the pandemic. Small communal areas were provided on multiple levels of the building instead of in one big area. The building increased to 15 stories, the maximum, without an increase in the number of units.

An amendment was needed to increase the gross floor area by 35,000 sq ft and to delay the closing of the Senior Living portion of the project until January 2023. The Senior Living building was now referred to as Phase 1B, with a later Closing Day. It was agreed that the four yearly land lease payments of $4.5 million would begin at the closing date on the remaining buildings in Phase 1 in December 2021, with an option to extend to April 2022. This amendment was approved August 9, 2021.

Delay, then a Phase 1 closing, at last! – May 2022

As the end of April approached, Mr. Shields went before the City Council to report that both sides needed two more weeks to finalize the deal. At the April 25, 2022, City Council meeting, a frustrated Mayor Tarter said, “Time is money … it’s actually the tax revenue the City is deferring or delaying for a period of weeks, so I guess from my perspective I’d say this is it! … This transaction was known to be closing a year ago, [even] a year and a half ago, so it’s not like…this deal just got put together today. [It] got put together many, many, many months ago and everybody knew when the deadline [was].”

On May 13, 2022, closing for Phase 1 was executed. The clock started on the agreed payments beginning with the first $4.5 million capitalized lease payment and a land lift payment of $180,000. By now, the project included 810,000 gross square footage in commercial and residential buildings.

FCGP also became WF Developer, LLC (WF). Ownership of the land parcel for the condominiums was passed to WF for sale to the condominium owners.

Under Virginia law, the City can only lease its lands for up to 40 years. To execute a 99-year lease, the City transferred the West Falls land parcels for commercial use to the City’s Economic Development Authority (EDA). The City and the EDA signed a Memorandum of Understanding (MOU) stating that the lease payments and ground rents were to be returned to the City.

More delays on the Senior Living component – 3rd, 4th, 5th, 6th, 7th amendments

As the new Senior Living operators developed their plans, they requested more time to close Phase 1B, resulting in more amendments. But at its June 12, 2023, meeting, the City Council was informed that Trammell Crow had pulled out, and WF was in talks with a new Senior Living operator. In September 2023, WF announced that Experience Senior Living (ESL), LLC, would be both the Senior Living operator and the developer, and asked for a further delay in the Phase 1B closing to October 31, 2024. Days before this deadline, another month delay was sought, and closing is now scheduled for November 30, 2024.

Once the Senior Living component is in operation, the City would receive $228,000 per year, with 3% annual escalation, for its affordable housing program in lieu of actual affordable units.

An animation to put it all together

The Pulse produced this animation to show how the main elements of the public-partnership agreement changed from the first Interim Agreement through the Comprehensive Agreement and all its amendments to date. The Phase 2 payment is shown as the latest date (June 2029) if the three yearly extensions are requested. This payment could be higher if the land market value appreciates.

Payments received from the West Falls project by FY2024

| Fiscal Year | Amount |

|---|---|

| 2020 | $6.5 million |

| 2021 | – |

| 2022 | $4.68 million |

| 2023 | $4.68 million |

| 2024 | $4.68 million |

| Total to Date | $20.54 million |

The City has received the first four land lease payments. The $4.68 million payments in the table include installments of 50% of the “land lift” at the closing of Phase 1, i.e. the increase in the land assessment at the time of closing (May 2022).

Phase 1 is expected to be completed by early 2025. The development assessment should be approximately $400 million, yielding about $4.8 million in property taxes annually at a tax rate of $1.21. However, because of the PILOT, the City will not receive the full property taxes from the leasehold commercial buildings until 2029. The finished condominiums are not included in the PILOT and will be subject to the full property taxes.

Update, July 15, 2025: The City received $571,000 for its first real estate taxes from this project was in FY2025, below the $1 million cap. The FY2026 real estate taxes are projected to be $825,000, also below the $1.5 million cap. Both underpayments were explained as the result of the Senior Living building being delayed.

How has the City paid for the school bonds debt service?

Debt service for the school bonds is about $6 million a year. In the FY2021-2022 Budget report, City Manager Shields wrote:

“To meet the debt service requirements for this $120 million investment, the City has raised taxes (8.5 cents are dedicated to debt service for this project,) and the City has executed a Comprehensive Agreement with Falls Church Gateway Partners for a 99-year ground lease for approximately 10 acres of the former high school property.

Due to the COVID-19 pandemic, and its negative impact on the ability to finance commercial development for hotel, retail, and office in particular, the City and FCGP negotiated changes to the terms of that ground lease. The City allowed a reduction in the ground rent over the next five years in exchange for an increase in ground rent for the remainder of the 99-year term of the lease.

The success of this West Falls project remains an important priority for the City to accomplish the plan of finance for the high school without additional increases in tax rates.”

References

- History of GMHS Campus Project, Superintendent Peter Noonan memo, July 17, 2017.

- George Mason High School Bond Referendum Information Session, September 10, 2017, Wyatt Shields, City Manager, and Peter Noonan Ed., Superintendent of Schools. Presentation slides.

- F.C. LIVE ELECTION RESULTS: November 7, 2017, Falls Church News-Press. Results of the 2017 school bonds referendum.

- WFC GMHS Site BAFO Negotiation Summary for Council 11-19-2018 v4. Alvarez & Marsal and Bolan Smart Associates. Contains financial slides for the initial Interim Agreement.

- November 19, 2018, City Council Meeting. Approval of the Interim Agreement. This official video will not display properly on a small screen as it includes the agenda.

- December 17, 2020, Town Hall. Online discussion of the first amendment to the Comprehensive Agreement.

- April 25, 2022, City Council meeting. YouTube video.

- City Council Resolution of Approval with VCs, October 24, 2022. Senior Living voluntary concessions.

- Fiscal Year 2022 Adopted Budget.

- The West Falls Project. This is the City’s webpage on the West Falls Project that has links to most of the resources used in this post.

- West Falls Project Lease Terms. October 28, 2024. City Council presentation materials.

- West Falls Financials Summary. December 2, 2024. City Council presentation materials.