Update: City Manager Proposes 3-Month Study of Fee-Based Trash Service

Update (May 2, 2025):

City Manager Wyatt Shields has recommended that the City Council appoint a Solid Waste Task Force to study and report on options for handling this service. The task force report would be due by August 4, 2025, and would give City staff time to evaluate the alternatives for implementation in FY2026. The Council will discuss formation of the task force at its May 5, 2025, work session.

The staff report on the Solid Waste Task Force calls for the body to consist of the following members: “a City resident owner of a City single family detached home; a City resident owner of a town house; a City resident owner of a condominium; the City Solid Waste Coordinator; the City Treasurer; and such other members the City Manager views as necessary to complete the work.”

Mr. Shields said at the April 24 budget town hall that the Council may consider reducing the tax rate and implementing a solid waste fee. If a fee is adopted, the FY2026 real estate tax rate could be lowered by 1.5 cents and replaced with an estimated flat solid waste fee of $332 or a variable rate of $337 for a 65-gallon bin or $284 for a 35-gallon bin. Such a change would be implemented as a line item in the City’s November 2025 real estate tax bills, he explained.

The City Manager said during the town hall that he does not think expanding solid waste pick-up services to multifamily condominium buildings is viable because of the many ways in which these buildings organize solid waste for collection and the need for a tax rate increase to cover the added cost. While Mr. Shields initially said the task force would study this option, the staff report for the May 5 City Council work session precludes this option, stating: “The idea of studying providing solid waste services to condominium associations has been discussed in earlier staff presentations to the City Council. To date, the condo associations that have spoken out on this topic have not expressed interest in the City providing solid waste services to condo associations and have instead expressed support for adopting a fee for the curbside service and removing those costs from general taxes. Staff concurs that providing service to condos would be highly challenging to implement. For these reasons studying the provision of solid waste services to condos is excluded from the proposed scope of work of the Task Force.”

References

Mayor Pushes for Fee-Based Trash Service

April 16, 2025

Summary

At the March 24, 2025, budget presentation Mayor Letty Hardi directed staff to look into the feasibility of implementing a fee-based trash collection service in FY2026. Staff returned in April with the cost data while pleading for more time to implement such a plan.

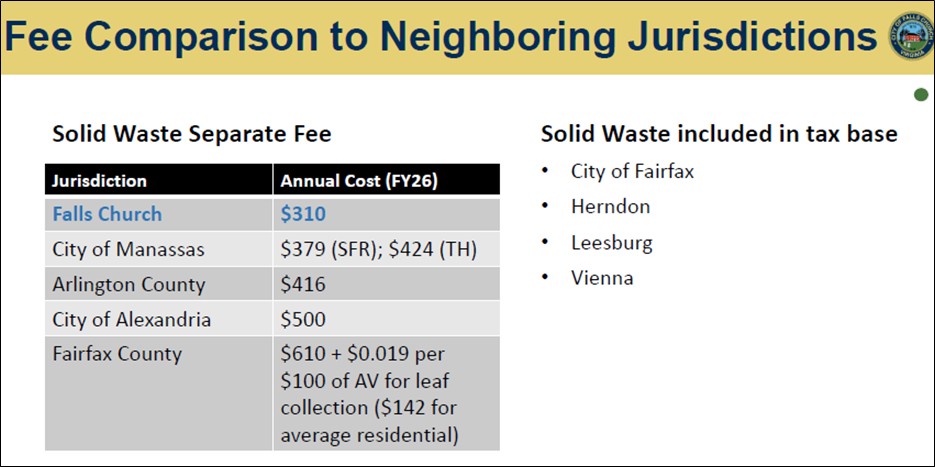

The analysis estimated that a $310 annual fee per household would be needed to cover the cost. It would be budget-neutral to reduce the tax rate by 1.5 cents for all real estate and charge the 3,066 homeowners currently receiving service a flat fee of $310.

Some Council members were concerned that the net impact of such a plan would be hardest on the least expensive homes and the community had not yet been informed of the proposed change. Also, it would negatively impact the school budget unless an adjustment is made.

Meanwhile, condominium owners urged Council to implement this as soon as possible. They say they are currently paying for a service they do not receive.

Background

In response to residents at Park Tower Condominium who have been asking the City to include them in the City’s solid waste services for several years, saying it was unfair that they pay taxes but do not receive the service, staff presented options last October to move to a fee-based trash service. The issue arose again during the FY2026 budget discussions when Mayor Letty Hardi expressed an interest in seeing a fee-based plan implemented in the coming fiscal year.

At the April 7, 2025, work session, staff provided cost estimates for two of the fee-based options.

Why move to a fee-based, solid waste collection service?

In return for allowing multifamily developments in the City, developers agreed to provide their own solid waste services. These services were also included in the City’s Special Exception negotiations for recent mixed-use developments. More recently, Madison Homes stated that the townhouses they are constructing on Park Avenue will also have their own trash services, and the terms will be included in the homeowners’ association (HOA) articles. Further, commercial properties must procure their own solid waste services.

However, condominium owners at Park Towers say they should be eligible for City solid waste services as they pay the same real estate taxes as owners of single-family homes that receive services. Their HOA fees pay for private trash collection; therefore, they believe they are unfairly paying double for these services.

City Manager Wyatt Shields pointed out that the City pays for solid waste services from all its tax revenues – residential, commercial, sales, meals, etc. The cost of these services is not taken out of the real estate taxes, specifically. Nevertheless, the City Council believes that this is an “equity” issue and wants to find a way to resolve the situation.

In October, 2024, staff provided two fee-based options, the option of also providing services to multifamily buildings and the option of providing these residents a rebate. Staff did not believe that these options were viable. A majority of Council members supported the fee-based option as the more “equitable” choice. The 3,066 homeowners who receive services today would pay a trash collection fee instead of having that cost taken out of the general tax revenues.

At the March 24, 2025, budget meeting, Vice Mayor Debora Shantz-Hiscott proposed “decoupling trash fees from the tax rate and ensuring that we’re only charging the single-family homes for services received for trash removal.” Mayor Letty Hardi directed staff to explore implementing the fee-based, solid waste fee option in the FY2026 budget.

A fee-based service costs lower-valued homes more

Today, solid waste services are the responsibility of one person, Lonnie Marquetti, the City’s Solid Waste Coordinator. This efficiency is largely due to the simplicity of a service paid with general tax revenues. In moving to a fee-based trash service, the City Council is mindful that Falls Church does not end up increasing management overheads.

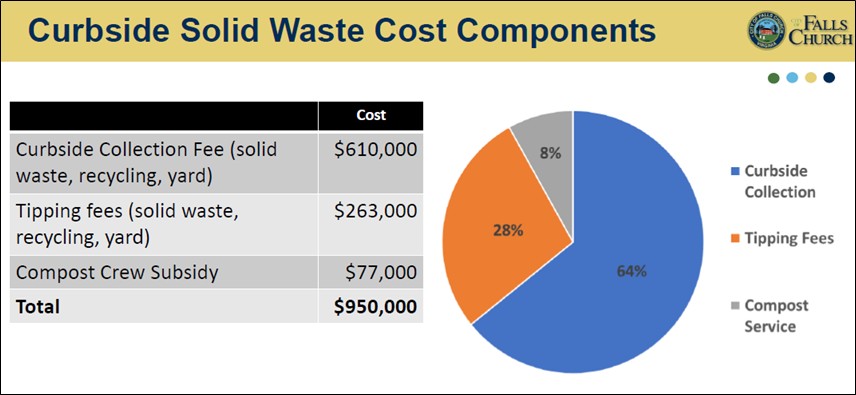

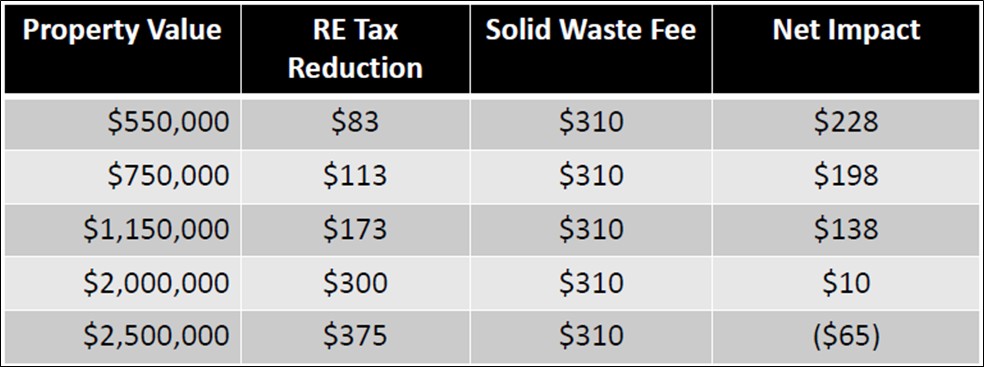

The table above shows the costs associated with the weekly trash services to homeowners. Removing $950,000 from general tax revenues is equivalent to a reduction in real estate tax rate of 1.5 cents on both residential and commercial properties. Each penny on the tax rate is equivalent to $630,000.

If a flat fee is imposed, each household would need to pay $310 a year, to be collected with the real estate taxes. At the March 24, 2025, Council meeting, Mayor Hardi said, “I think figuring out whether you pay for solid waste in the general fund or fee is budget neutral.” However, it is not payment neutral for homeowners as the analysis below shows. Staff provided the following table to compare the impact on homes of different values.

The analysis shows that 1.5 cents in real estate tax rate reduction is insufficient to compensate homeowners of less expensive properties for the solid waste fee, with the greatest negative impact on the least expensive homes. A 1.5 cent rate reduction on a $750,000 home is $113, but that homeowner would need to pay $310 in solid waste fees and so is $198 worse off. Wealthier homeowners in $2.5+ million houses end up ahead by $65.

By extension, the large mixed-use developments, valued at tens of millions of dollars, including the $400 million projected valuation of the West Falls development, will receive large tax cuts as a result of the Mayor’s proposal.

Equity for some, more financial pain for others

Council Member Laura Downs expressed reservations. “This chart bothers me. The people with the lowest property values are going to have that impact…. those more expensive houses can afford to pay more, I would assume.”

Deputy City Manager Andy Young said that they also considered a two-bin option where homeowners could get a smaller bin at a slightly lower cost of, say, $262. The impact on smaller properties was only slightly reduced because these costs are mostly fixed.

Council Member Justine Underhill, in support of the fee-based trash service,explained to Ms. Downs, “This chart looks particularly regressive [due to] the fact that anytime we do a tax cut there’s a bigger tax cut for the homes that pay more in property taxes.”

Council Member Erin Flynn also said she is troubled by the proposal. She views it as a tax policy that is redistributive, and said, “There may be reasonable, justifiable reasons for doing [this]…you see that net impact and it looks so stark on those households that are much more below the median household value… I’m struggling with it, also recognizing that the variable fee isn’t justifiable in terms of staff resources for the size of the City…”

Alternative options for achieving equity

Council Member David Snyder is not in favor of the fee-for-service plan but prefers making condos eligible for the City’s solid waste service. He was frustrated that staff did not provide data on the cost of providing this service to condos. “There are two ways to achieve equity. One way is to take services away from everybody and make everybody pay. Another way to achieve equity is to bring other people into these basic services,” he said. “I’d like to see those other options fleshed out before we make a decision on this issue.”

Ms. Flynn repeated her earlier request for staff to explore the option of providing tax credits to condo owners or the HOAs, perhaps at 1.5 cents of the assessed value, to go toward their private trash service.

Ms. Marquetti said that the current ordinance would need to be amended to allow the City to work with the condo units, and she would also need to work with the HOAs. It would be more involved than the City’s current solid waste contracts. Mr. Shields said it would require time and effort to explore these options, and no other nearby jurisdictions employ them. He added that he would only work on those options if the City Council directed him to do so. There was no support from the rest of the Council for this concept.

Further, if the City were to provide trash services to the condos, this expense would need to be absorbed into the City’s operational budget without additional taxes or fees.

Adding a third bin for organics/composting

Ms. Underhill asked to include a third organics/compost bin that staff estimated would increase the fee by $22 per year. Ms. Flynn pointed out that if we are moving to a fee-based trash service for equity reasons, it would not be equitable to then force City-serviced households to pay for the compost bin when condos and apartments are not required to provide the same service. Mayor Hardi replied that residents would not have to take a compost bin if they didn’t want one, but this would remain a flat fee for everyone.

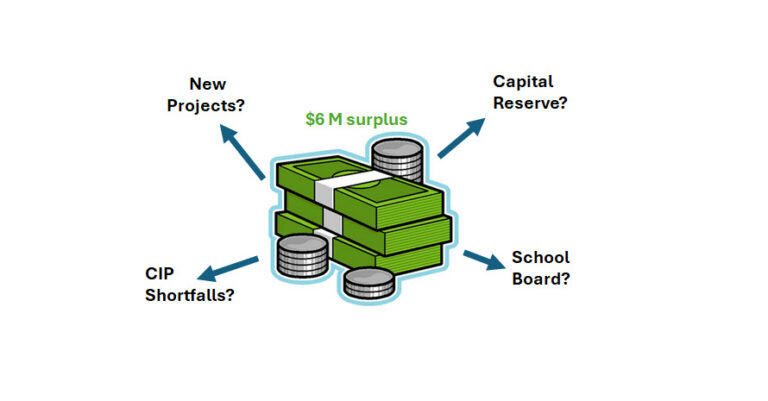

Possible negative impact on the school budget

Ms. Downs had been contacted by some “panicked” members of the School Board who question how the school budget will be impacted by changes to paying for solid waste services. Under the revenue sharing agreement, the School Board and the City share local tax revenues equally. If the tax revenues were replaced by fees, would the school’s share also be proportionately reduced? Mr. Shields acknowledged that an agreement on this point would need to be worked out with the School Board.

Mayor pushes for FY2026 implementation

Mayor Hardi explained the need for FY2026 implementation as follows, “If you’re a single-family and town home[owner], you would see a 4 cent* cut plus [a] $332 [fee]. So, if we don’t expect future tax rate cuts, making this change is that much harder because you don’t have the first 2.5 cents to help make it easier… That’s why I think the timing matters…, and we’re only going to have more multifamily and condos come online – they will have further subsidized single-family homes so the numbers are even that much harder to overcome.”

(*The Mayor assumed a 2.5 cent tax reduction in FY2026, plus 1.5 cents for moving to a fee-based system, and the 2.5 cent reduction is now unlikely, given the City and the region’s overall financial outlook. Read the Pulse budget post.)

Ms. Underhill and Ms. Shantz-Hiscott were in firm agreement with the Mayor.

Ms. Downs said it was critical to communicate this change to the community, although she agreed with Ms. Hardi that getting it done in FY2026 would make it easier to justify to the public. She also said she needs the school budget impact to be resolved.

Mr. Snyder said more community discussion was needed and that the City Council has not heard from the single-family homeowners who will be most impacted by such a fundamental change.

Ms. Shantz-Hiscott disagreed with Mr. Snyder, saying, “I see it as a policy discussion…. I don’t think it’s something that hasn’t been discussed in public, but I do think the communication of it and why is really key. I also think that we, as a body, are creating policy, and that our experts and staff should be figuring out how to implement it.”

Council Member Marybeth Connelly wanted to wait, saying, “I feel like it’s too rushed and there’s not enough community engagement in it. If we’re going too fast, we’re going to make mistakes.” Ms. Flynn agreed.

Staff pleads for more time

City Manager Shields opened the meeting saying that staff would prefer this change to be implemented in FY2027. He said there are too many questions being raised to realistically be able to implement a fee-based trash service in FY2026, but pledged to put together a plan for a decision to be made in time for FY2027. City Treasurer Jody Acosta advised the City Council that she is leery that the necessary software changes to carry out the billing could be done in time for FY2026. The Council initially agreed to delay until FY027.

Growing support from condominium owners

At the April 14, 2025, City Council meeting, residents of the City’s other condominiums including the Broadway, Spectrum, Byron, Falls Plaza, and Cherrywood town homes, supported moving to a fee-based trash service. They pressed Council to implement this plan in FY2026. Mr. Shields reiterated that more time would be needed to implement this plan for the May 12 budget vote. However, he raised the possibility of making an unprecedented tax rate amendment in August for FY2026. Such a schedule would also allow time to communicate this change to the community.

References

- City Council meeting, March 24, 2025. YouTube Video, starting at discussion on solid waste services.

- City Council work session, April 7, 2025. YouTube Video, starting at discussion on solid waste services.

- Solid Waste Presentation, April 7, 2025.