The FY2024 Year-End Financial Report – a $6 Million Surplus!

Summary

- The $6 million surplus included $2.8 million in higher investment returns for FY2024, because the budgeted return was for 1.5-2%. The FY 2025 budget assumes a 4% return.

- Tax revenues were higher by $1.9 million (2%). About 400 new cars in the City’s new multifamily buildings accounted for some of the $905,000 higher personal property taxes. Meals tax revenue was $553,000 higher, even though the City had eight fewer restaurants than in 2023.

- General government spending was about $714,000, or 0.6 %, below budget after carrying forward to FY2025 more than $107,000 in commitments made in 2024.

- The City is on track to use all of its allocated $18 million from the American Rescue Plan Act (ARPA) by December 2024.

- City Council’s discussion and decision on how to use this money is in the companion post, City Council Reviews Options for the $6 Million FY2024 Budget Surplus.

FY 2024 year-end financial report

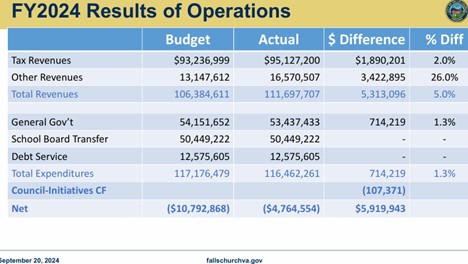

The 2024 financial year ended on June 30, 2024. The comparison of the FY2024 Budget to Actual numbers was first presented at the City Council Budget and Finance Committee (BFC) meeting on September 20, 2024, and then at the City Council meeting on September 23. Total City revenues exceeded the budget by $5.3 million (5%), and the general government expenditures (City Hall) were below budget by $714,219. The total year-end surplus is $6,027,314. Excluding $107,371 to be carried forward for 2024 commitments, the net year-end surplus is $5.9 million.

Source of the $5.3 million revenue surplus

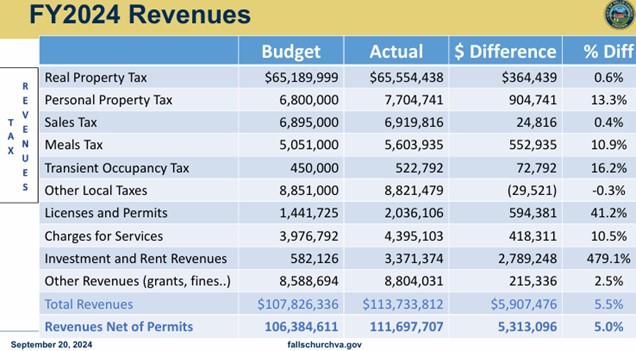

The table below shows the breakdown for the increased revenues. The larger than expected personal property tax was explained by new registrations of approximately 400 cars in the City, primarily from multifamily development projects. Meals tax was higher even though the number of restaurants decreased from 149 restaurants in 2023 to 141 restaurants in 2024. Two new hotels opening at the end of FY2024 added to the transient occupancy tax. Total tax revenues were $1.9 million (2%) higher than budgeted.

The most significant non-tax revenue variance came from higher returns on investment. The FY2024 budget assumed a return of 1.5%-2% on City investments. Interest rates were much higher, yielding a surplus of $2.8 million. (For the FY2025 budget, a rate of 4% was assumed.) Licenses and permits for construction projects were higher than budgeted. Fees for athletic programs in the City were cited as one of the better performers, resulting in higher charges for services than budgeted.

(All revenues from Permits and Licenses are set aside to cover the City’s expenses for providing the services related to those permits and licenses. They are, therefore, not included in the surplus.)

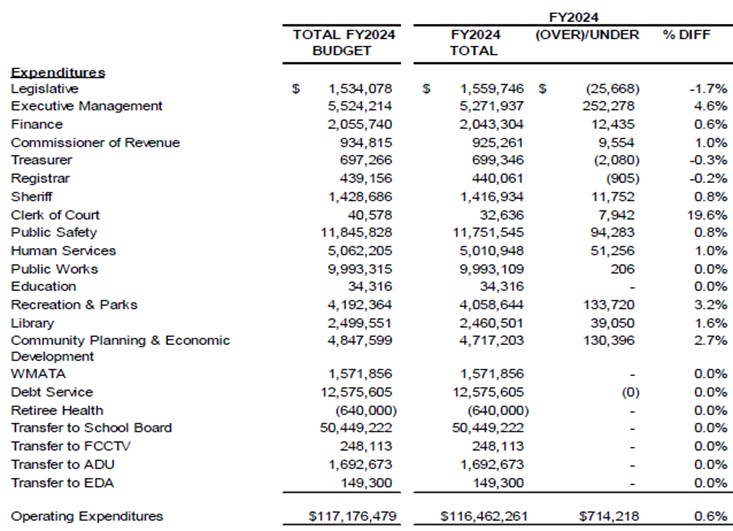

Lower general government spending

The table below shows that the City general government expenditures were $714,218 less than budgeted. The difference for each department is shown in the table below. Of this amount, $107,371 needs to be carried forward into 2025 for commitments made in 2024, leaving $606,847, or 0.6%, in underspending.

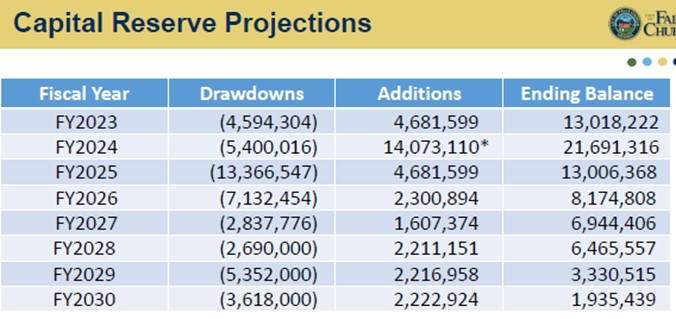

Capital Reserve projections

The year-end report included an assessment of the Capital Reserve, the fund designated for capital improvement projects (CIP) and debt service. (Note that the City has another reserve, the Unassigned Fund, that is the “rainy day” fund.) The City’s financial policy is to set aside the lower of 5% of the General Fund capital assets, or $3.75 million.

The Capital Reserve at the beginning of FY2024 was $13 million. $14 million was added to this reserve in FY2024, $8.4 million from the sale of the VA tech grad center land, $4.68 million from the West Falls land lease payment, and $962,000 appropriated from the FY2023 surplus.

Several CIP projects in the six-year plan and debt service on the school bonds to build the new high school are expected to draw down these reserves. (Read Pulse post, The Capital Improvement Program (CIP) 2025 and Beyond, April 16, 2024.) The current projections are shown in the table.

Update on the use of $18 million in ARPA funds

The City received a total allocation of $18 million in funds from the American Rescue Plan Act (ARPA). These funds must be “encumbered” by December 31, 2024, and expended by December 31, 2026. To date, the City has spent $12.5 million and has appropriated all but $129,935.

References

- City Council meeting, September 23, 2024. This official video will not display properly on a small screen because it includes the agenda.

- FY2024 YE Report and ARPA Update, September 23, 2024.

- FY2024 YE and ARPA Update. PowerPoint presentation, September 23, 2024.

- City Council Budget and Finance Committee meeting, September 20, 2024. This official video will not display properly on a small screen because it includes the agenda.

- City Council Budget and Finance Committee meeting presentation, September 20, 2014.