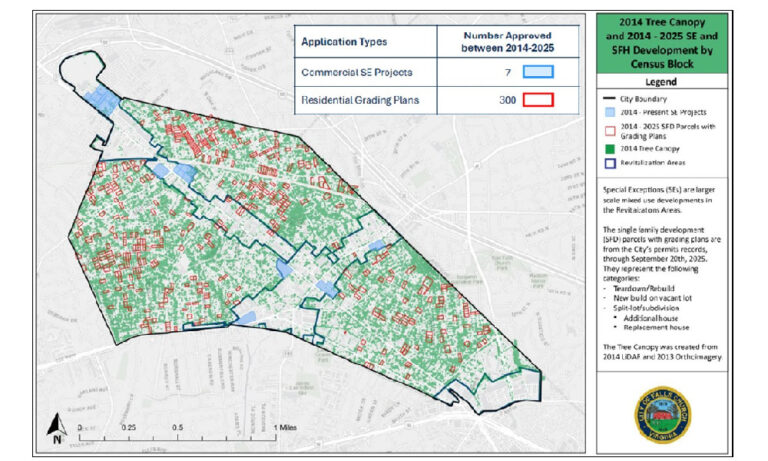

New Tree Canopy Ordinance is Limited to 10%, But City Policy Can Go Higher

City Council voted for a new 10% tree canopy ordinance for commercial properties. Staff wants this to be followed by changes to City policies for even more canopy, as neighboring jurisdictions have done.