West Falls Part 4 – Special CDA Assessments to be Paid by All West Falls Properties

Summary

- A Community Development Authority (CDA) was established to raise $13 million by issuing 30-year municipal bonds, with the money to be used for infrastructure within the West Falls site.

- To raise funds annually to service this debt, the CDA imposes special assessments on all the taxable properties in the West Falls development. These annual collections are in addition to real estate taxes.

- On April 17, 2025, the CDA approved the apportioning of the condo building special assessment among the individual condos at the Oaks in West Falls. On average, the 2025 payment is $1,232 per condo. The developer will make these payments for any unsold condos.

A Community Development Authority (CDA) to pay for infrastructure

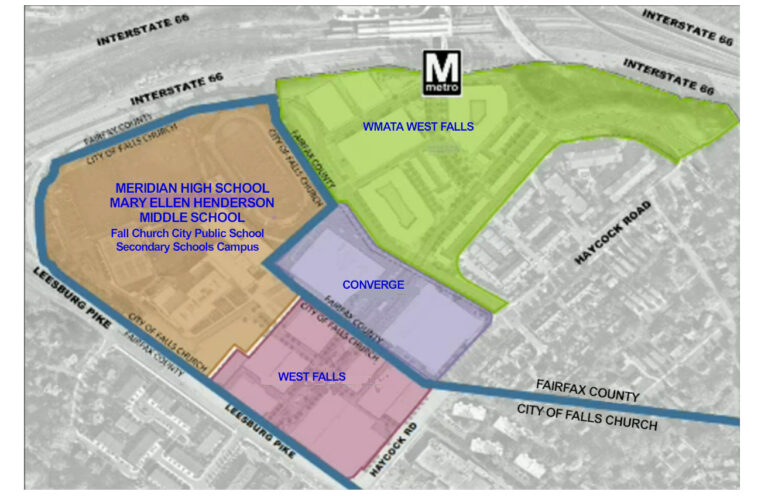

When Falls Church City leased the10 acres of land to FCGP, LLC, to build the West Falls development, FCGP was responsible for all the infrastructure within the site. This included roads, sidewalks, sewer lines, stormwater systems, and utilities. The City was responsible for providing hookup points to the sanitary sewer mains and the stormwater drains.

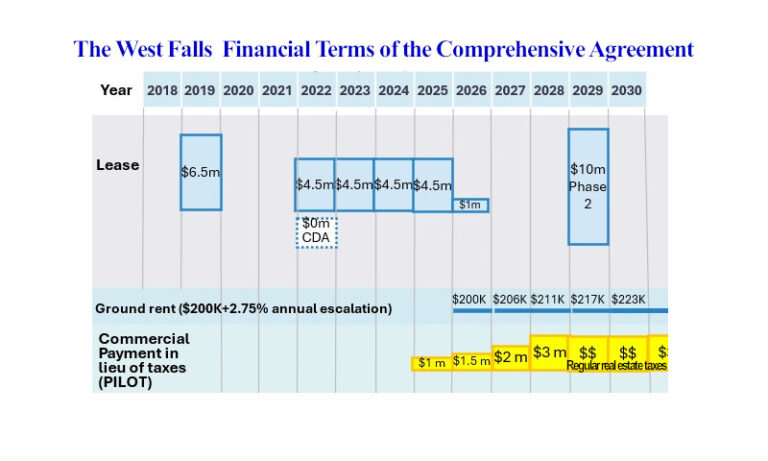

In the initial Comprehensive Agreement (CA) that defined the public-private partnership behind the West Falls project, FCGP initially offered to pay the City $2.5 million if the City were to help FCGP raise an estimated $15 million for the infrastructure within the site using a funding vehicle available to localities – the Community Development Authority (CDA).

The CDA has the ability to issue tax-exempt Virginia municipal bonds to pay for public improvements for a specific district in the locality. These bonds are then repaid through a special assessment or tax on the property owners in that district and are collected by the locality.

In January 2021, blaming the Covid-19 pandemic, FCGP renegotiated to reduce the Phase 1 land lease payments from $35.5 million to $25.5 million, and to require that the City establish a CDA without the developer’s initial $2.5 million offer. Although these municipal bonds would be issued by a City entity, the City would not provide “moral backing.” Council members were assured that the City’s taxpayers outside the CDA district of West Falls would not be liable for paying the bonds.

Establishing the West Falls CDA

The establishment of a CDA was new to the City. The City relied on outside counsel Peter Canzano to stand it up. MuniCap, Inc, public financing consultants, would oversee the CDA bonds and special assessments.

The July 12, 2021, staff report on the ordinance to establish the CDA stated:

“The intent of the parties is that the CDA will issue $12 to $15 million in bonds, the proceeds of which will be used for some of the costs of infrastructure for the site, and that a special assessment will be made and allocated among the various taxable parcels on the site to pay the costs of debt service. …”

Despite stating that “It is important to the tax exempt status of the bonds, that the CDA not be controlled by the private developer or any other private entity,” the report then proceeded to list the makeup of the five members of the CDA as:

- One City Council Member

- One Economic Development Authority (EDA) Member

- One Staff Member

- One City Resident Member

- One Member suggested by the developer and appointed by the Council in its sole discretion.

Unbeknownst to the City staff, then Planning Commissioner Derek Hyra was very familiar with CDAs. Mr. Hyra is a professor of Public Administration and Urban Policy at American University. He was concerned that the CDA ordinance had not capped the maximum amount of bonds that could be issued. He also said, “I have never seen a spot designated for the developer. … I thought that was sort of a red flag for me that we would be slotting a developer or developer’s interest on this.”

Mr. Hyra’s warnings were heeded. When the CDA was established on August 9, 2021, its members were:

- Debora Shantz-Hiscott, City Council Member and Chair

- David Snyder, Council Member

- Robert Young, Chair of the EDA; now Alan Brangman, EDA Member, since Mr. Young’s death last year

- Wyatt Shields, City Manager

- Kiran Bawa, City Finance Director

The CDA bond issue

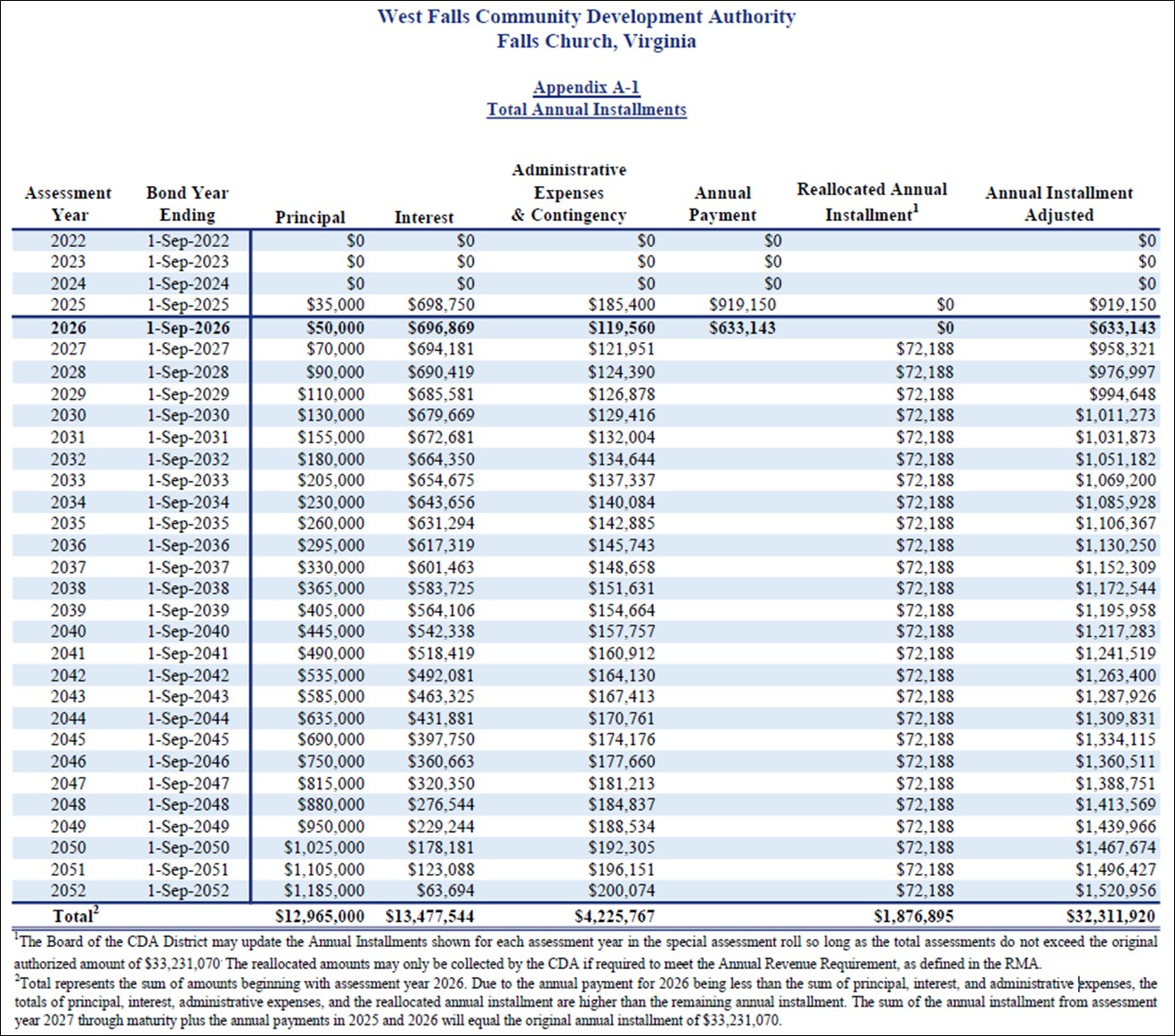

On July 27, 2022, the CDA issued $13 million in West Falls Community Development Authority Revenue Bonds with a coupon rate of 5.375% interest payable semi-annually from September 1, 2022, through the maturity date of March 1, 2052. Semi-annual interest payments were capitalized through September 1, 2024, with payments beginning in 2025.

Special assessments to repay the bonds

The bonds, interest, and associated administrative costs are to be repaid by imposing and collecting special assessments from all taxable property within the West Falls district. The assessments, totaling $33 million, are apportioned according to an agreed formula based on the size of and revenues from the properties. Each year, property owners must make an installment payment toward that assessment. This money is then used to service the CDA bonds.

Appendix A-1 shows how the $33 million in total assessments is derived from the schedule of payments over the 30-year life of the bonds (rightmost column) plus administrative costs. For 2025, $919,150 must be collected from these assessments.

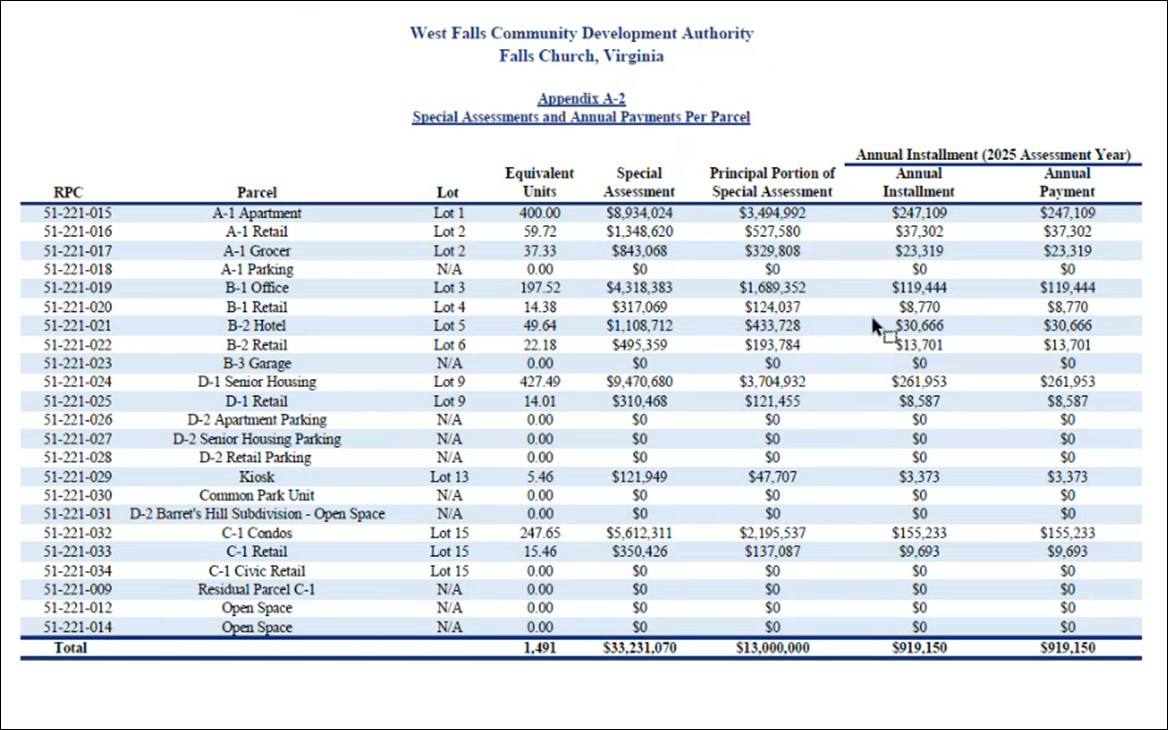

Appendix A-2 shows how the total special assessment is apportioned among the property owners according to its “equivalent unit” (EU) value and original land parcel value. The EU is intended to reflect the relative size and revenue from the property. For example, the special assessment imposed on the apartment complex is $8.9 million, of which $3.5 million represents the apartments’ share of the bond principal. The latter is used to determine its share of the overall annual installment. For 2025, the apartment complex must pay $247,109 as its special assessment installment payment.

All condos are subject to special assessments

At the April 17, 2025, meeting of the West Falls CDA, the board approved the FY2026 special assessment collections that, for the first time, included special assessments imposed on individual condominiums at the Oaks. The Oaks’ (C-1 Condos in the table above) total special assessment of $5.6 million was apportioned among its 126 units according to their size. For FY2026, the average installment payment is $1,232 per condo, although the individual payments vary from $692 to $2,022. These payments are in addition to the regular real estate taxes that a condo owner must pay. The developer is responsible for making these payments until the condo is sold.

At the CDA meeting, October 22, 2024, Council Member David Snyder asked, “Can the condo owner challenge the assessment?”

Mr. Canzano, attorney for the CDA, explained that the assessment is set up by contract with the landowner. Each condo contract is recorded in the land records so that each successive owner is bound by the original contract making it difficult to mount a successful challenge.

At the October 2024 and April 2025 CDA meetings, Mr. Snyder sought and received assurances from the CDA’s public finance and legal consultants that the authority is acting in accordance with the law and recognized practice and in the City’s best interest.

References

- The West Falls Community Development Authority webpage. Official City webpage containing the membership and bylaws of this entity.

- West Falls Community Development Authority meeting, April 17, 2025.

- West Falls CDA (City of Falls Church): Updated Report on the Collection of the Annual Payment and Update of the Special Assessment Roll, Assessment Year 2026, March 27, 2025, MuniCap, Inc.