The History of West Falls – Part 1. An Opportunity to Finance the Building of a New High School

Summary

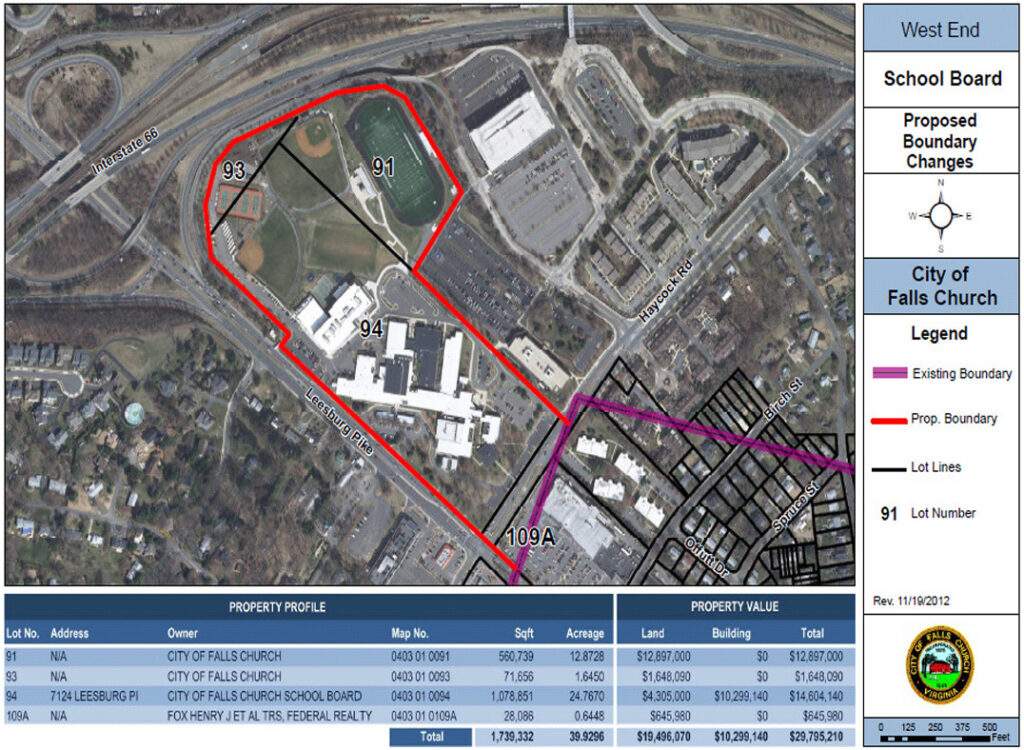

- The 2013 Boundary Adjustment Agreement with Fairfax County allowed the City to develop 30% of the City-owned lands around the high school and collect the tax revenues.

- A plan was conceived to help finance the construction of a new high school with the revenues from leasing 10 acres of this property for development, now called West Falls, via a public-private partnership.

- A 2017 referendum to issue $119 million of school bonds was approved by City citizens. City taxpayers would shoulder the entire burden of the debt service until West Falls generated revenues to help.

- In 2018, the City received six proposals in its search for a private partner. Only two potential partners submitted final proposals. The City settled on the EYA/Hoffman/Regency proposal. This group later became the Falls Church Gateway Partners (FCGP).

- Once an agreement was signed with FCGP in 2019 and a $6.5 million deposit was secured, the City issued $119 million of school bonds. However, no further revenues were forthcoming unless both parties closed the deal, planned for late 2021.

Background: The boundary adjustment agreement with Fairfax County

The City’s Water Wars with Fairfax County lasted from 2007 to 2013 and ended with the sale of the Falls Church Water utility to Fairfax Water. The terms of the sale included the adjustment of the boundaries between the City and Fairfax so that 34.6 acres of land owned by the Falls Church City School Board and the City, the school-related parcels, would come within City boundaries. Excluded from the deal was the adjacent City-owned land on Haycock Road, leased to Virginia Tech, between the high school and the West Falls Church Metro Station. (Read the Pulse post, Falls Church History – The Water Wars and the 2013 City/County Boundary Adjustment That Facilitates Development Of City-Owned Land, September 12, 2024.)

Furthermore, Fairfax County stipulated that “Up to 70% of the acreage of the School-Related Parcels, the composition of which acreage will be determined from time to time solely by Falls Church, shall be used for school purposes for a period of fifty (50) years…”

The boundary change was approved by a voter referendum and the Virginia Court at the end of 2013.

Planning and paying for a new high school

In 2014, the Falls Church City School Board turned its attention to updating the facilities at George Mason High School (GMHS). The options were to renovate the old school or to build an entirely new school. Either option was going to be much more expensive than earlier projects at the other three City schools. By 2017 the School Board had decided to build a new high school rather than renovate the existing school. $120 million had to be raised to build the new school, mostly with a school bond issue.

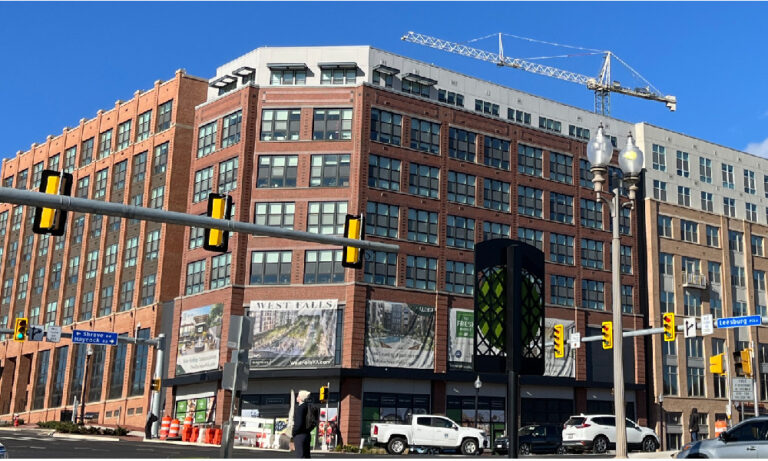

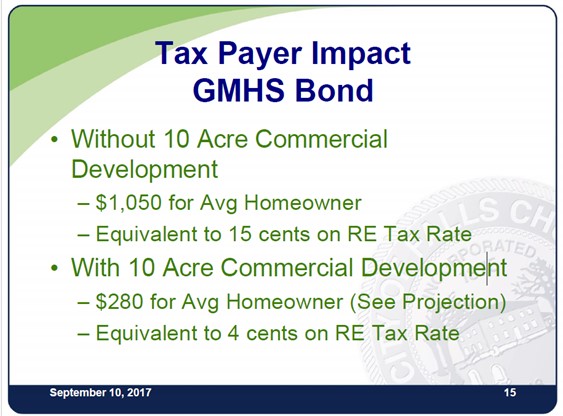

The plan was to develop the allowed 10.38 acres of land under the Boundary Adjustment Agreement and use the revenues from that development to help pay the annual debt service (principal and interest payments) on the school bonds. This acreage could be located anywhere in the school parcels but locating a high-density development at the intersection of a major highway seemed appropriate. Given its proximity to a Metro station, the City was confident there would be commercial interest and the City would benefit from the tax yields years after the school bonds were paid off.

This acreage included land where GMHS sat. Thus, development could not start until a new high school was built. Then the old GMHS buildings could be demolished to make way for the new development. According to this plan, taxpayers would shoulder the entire debt service until the development began generating funds to contribute.

The cost of a new high school

In 2017, the new high school was estimated to cost $120 million. A referendum was held in November 2017, asking voters to approve a bond issue for that amount. The interest rate was expected to be between 3.5% and 5% for 30-year bonds. At a town hall, residents were told about the tax burden involved. That November, 5,643 votes were cast, 63.6% were in favor, 36.4% were not.

The Public-Private Education Facilities and Infrastructure Act of 2002

The Virginia Public-Private Education Facilities and Infrastructure Act of 2002 (PPEA) provides an alternative procurement tool that does not require a Design-Bid-Build process and allows innovative approaches to financing school projects. All the Falls Church City schools have been built or renovated using the PPEA procurement process. The West Falls development involves such a public-private partnership.

The initial financial analysis for developing West Falls

Consultants hired by the City recommended leasing the land rather than selling it for better long-term benefit to the City. The land was valued at $43-45 million, whether leased for 99 years or sold. If that payment was received in the early years, it could be used to help pay for the school bond debt service while construction of the development proceeded.

Once finished, the West Falls development was estimated to be worth $400-500 million and would generate real estate taxes and other taxes for years to come. This “tax yield” would help cover the debt service reducing the burden on taxpayers. Staff estimated a net tax yield (after expenses) of $5-6 million. But no taxes would be collected until the buildings were completed and occupied.

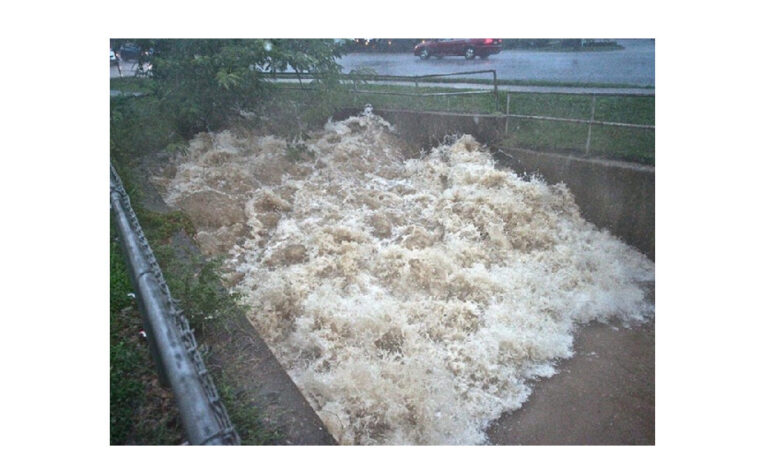

Accommodating this growth required public investment in the municipal infrastructure – roads, sidewalks, sewer lines, and storm drains. To date, public funds of more than $40 million have been spent in relation to this project, $25 million from grants and the remainder in bonds and cash reserves in the City’s general government and utility funds.

Executing the plan – selecting a developer partner for West Falls

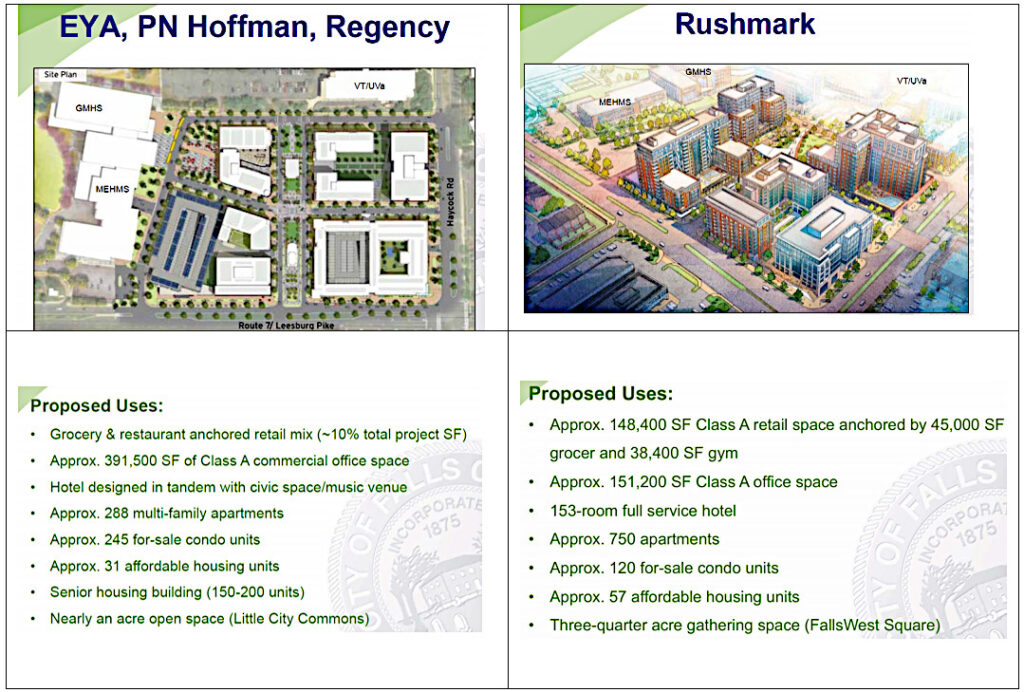

While the School Board worked on the new school, the City staff and City Council prepared to select a developer for the West Falls project. In 2018, the School Board chose Gilbane, Stantec and Quinn Evans to design and build the new high school. Meantime, City staff put out a Request for Conceptual Proposals to develop the West Falls site. Out of the six proposals received, three were invited to submit detailed proposals, and the City received two such proposals. They were from EYA/Hoffman/Regency and Rushmark and Comstock.

The proposals were reviewed by an Evaluation Committee comprised of:

- City Council Members – David Tarter, Letty Hardi, and Ross Litkenhous

- Economic Development Authority – Robert Young (Member and later Chair)

- Falls Church City Public Schools – Peter Noonan (Superintendent) and Erin Gill (School Board)

- Planning Commission – Russell Wodiska (Chair)

- City Staff – Paul Stoddard (Director of Planning)

- Bob Wulff (Consultant)

The evaluation criteria included the value to the City, the quality of the development, and the project execution risks. Below are summaries of the two detailed proposals. The financial section is not publicly available.

By November 2018, a decision was made to select EYA/Hoffman/Regency. (In 2020, Rushmark and Hitt Contracting were chosen to develop the adjacent Virginia Tech “grad center” property in Fairfax County.) The three companies formed a new business entity, Falls Church Gateway Partners Development, LLC, (FCGP), to be the developer of this site. Their proposal was to develop the project in two phases.

In Phase 1, they would develop:

- an office building,

- a mixed-use apartment building with a grocery store,

- a hotel,

- senior housing,

- a parking garage to be shared with the schools, and

- a condominium building.

In Phase 2, they would build:

- another office building,

- and a condominium building.

The City proceeded to work with FCGP on a Comprehensive Agreement (CA) that specified the terms of this public-private partnership. The CA was signed in May 2019 and secured with a $6.5 million deposit. Construction and further payments would not start until FCGP closed on the West Falls property lease. The City and the developers agreed that closing would be in the second half of 2021 to allow time for the new high school to be constructed.

The school bonds issue

When the referendum passed, the City raised its real estate tax rate for 2018 by 1.5 cents to its highest level of $1.355 in anticipation of the bond issuance. The tax rate remained at $1.355 for the next three years.

$22.3 million of bonds were issued in June 2018, with a portion used to pay for the feasibility and design phase. Once a Comprehensive Agreement (CA) was signed by FCGP in May 2019, the City issued another $119 million of bonds six months later. The debt service would be covered by taxpayers until the West Falls deal started paying.

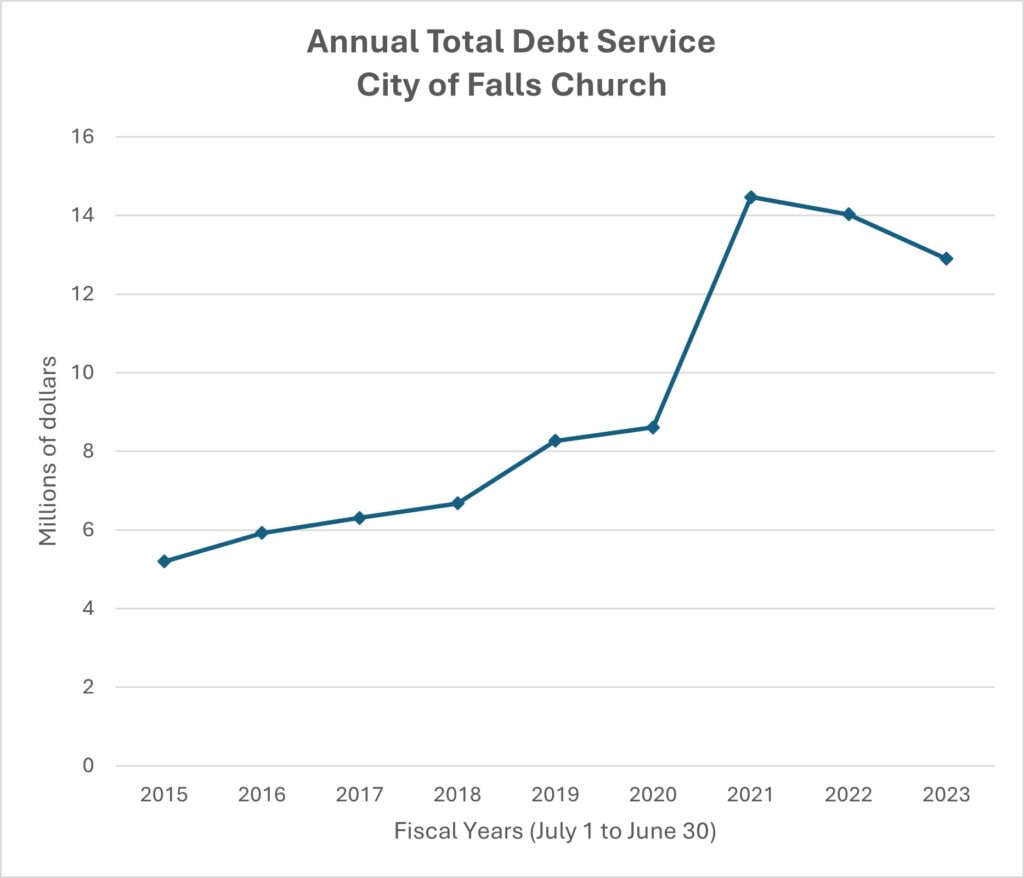

The resulting increase in the debt service on all City bond obligations can be seen in the graph. (Debt service is comprised of principal repayment and interest.)

Signing the CA did not guarantee that the project would be built. It is akin to signing a contract on a house. Nothing is firm until both parties close on the property. The CA specified a closing date in 2021, but the school construction was already underway, and the bonds had been issued. If FCGP walked away before closing, they would lose the $6.5 million. If either party walked away, the entire process would have to be restarted, further delaying revenues to help cover the school bonds debt service. For the City, the sooner West Falls was closed, constructed and finished, the sooner the relief to taxpayers.

Other unsolicited offers to develop West Falls

In 2015, the City received an unsolicited offer from Edgemoor Infrastructure and Real Estate, LLC to build the new high school and develop the adjacent land with no tax increase to residents. Edgemoor built Mary Ellen Henderson Middle School. This offer was received before the City issued its request for proposals. The School Board and the City decided against this offer in favor of separating the building of the new school and competitively bidding out the development of the adjacent 10-acre site with the goal of achieving more for the City.

While evaluating proposals in 2018, the City also received an unsolicited proposal from a company seeking to move its corporate headquarters to this region but decided to proceed with the West Falls development as described here.

A note on the videos and documents used in this research

Since selecting the developer in 2018, the City has held multiple town halls over six years of this development. There have been tens of City Council meetings, and they continue today as Phase 1B, which consists primarily of delayed senior housing, and Phase 2 of West Falls are yet to be finalized. We are fortunate to have the public records online in the form of meeting videos and accompanying documents.

However, most of the financial discussions have been held in closed sessions with the City Council, and the associated documents have yet to be made public. Financial issues have been discussed in private, while amendments to the City’s agreement with the developers have been finalized in public.

The City website has many webpages devoted to the West Falls development and the high school project.

References

- History of GMHS Campus Project, Superintendent Peter Noonan memo, July 17, 2017.

- George Mason High School Bond Referendum Information Session, September 10, 2017, Wyatt Shields, City Manager, and Peter Noonan Ed., Superintendent of Schools. Presentation slides.

- GMHS GILBANE AGREEMENT, July 23, 2018. Staff report on the Gilbane contract.

- F.C. LIVE ELECTION RESULTS: November 7, 2017, Falls Church News-Press. Results of the 2017 school bonds referendum.

- WFC GMHS Site BAFO Negotiation Summary for Council 11-19-2018 v4. Alvarez & Marsal and Bolan Smart Associates. Contains financial slides for the initial Interim Agreement.

- November 19, 2018, City Council Meeting. Approval of the Interim Agreement. This official video will not display properly on a small screen as it includes the agenda.

- The West Falls Project. This is the City’s webpage on the West Falls Project with links to the resources used in this post.

- History of the High School Campus Project. This is the City’s webpage on the construction of the new high school with links to the resources used in this post.