Adopted FY2026 Budget Shaves a Penny Off the Tax Rate

Summary

- A downward revision of the sales, meals, business, and personal property taxes by $1.2 million forced the City Council to walk back an earlier 2.5-cent real estate tax rate decrease. The adopted FY2026 budget managed a 1-cent reduction, from $1.21 to $1.20, through a $261,000 reduction in the general government budget and $145,000 reduction in the school transfer in the budget proposed in March.

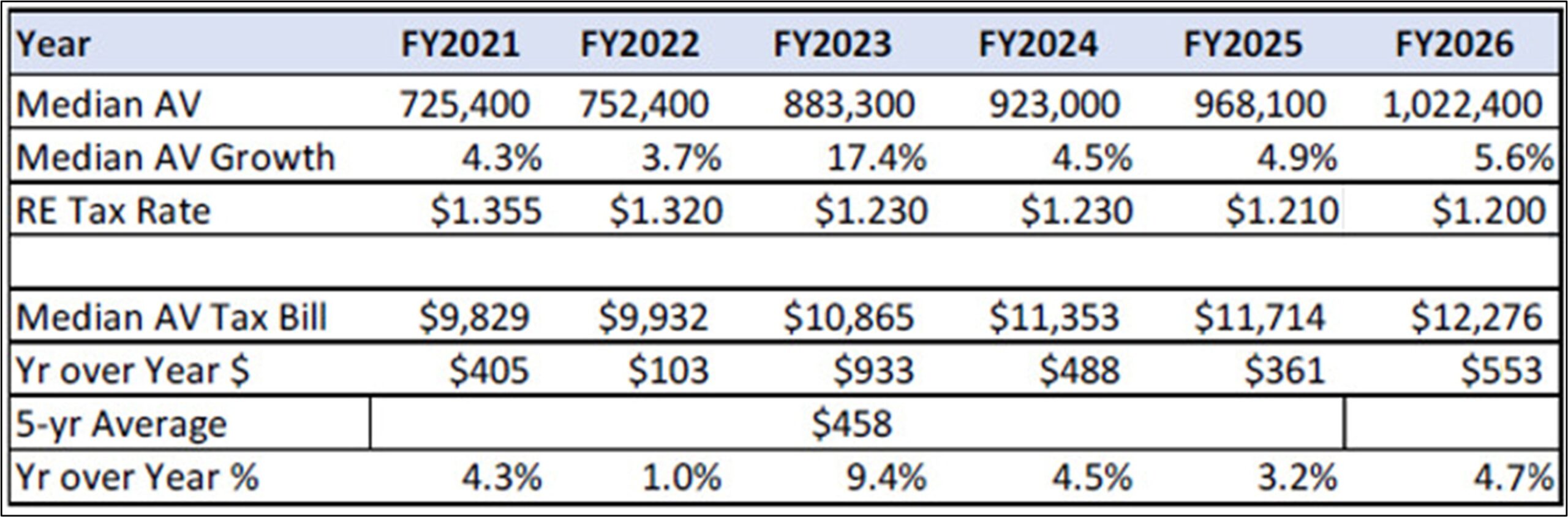

- The median home’s real estate taxes will grow by $553 or 4.7%. Stormwater fees and sewer fees will go up by $10 and $14 , respectively on average. This does not include expected increases for solid waste collection fees to be implemented later in the year.

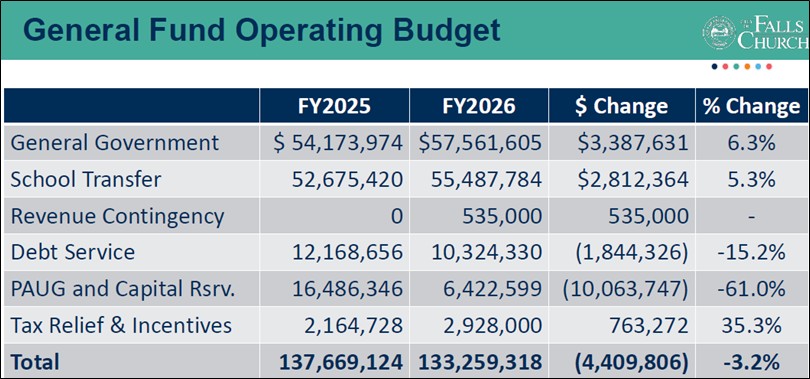

- The general government operating budget grew 6.3%, and the contribution to the school grew 5.3%. Overall budget decreased 3% from FY2025 due to lower capital expenditures and debt service.

- Real estate taxes form the bulk of the 5.3% tax revenue growth, with 80% of that growth from residential real estate. Residential assessments grew 6.85% on average while commercial assessments grew 2.37%.

- Negotiations highlight the challenges of the revenue sharing agreement for the School Board during economic downturns, despite growing enrollment.

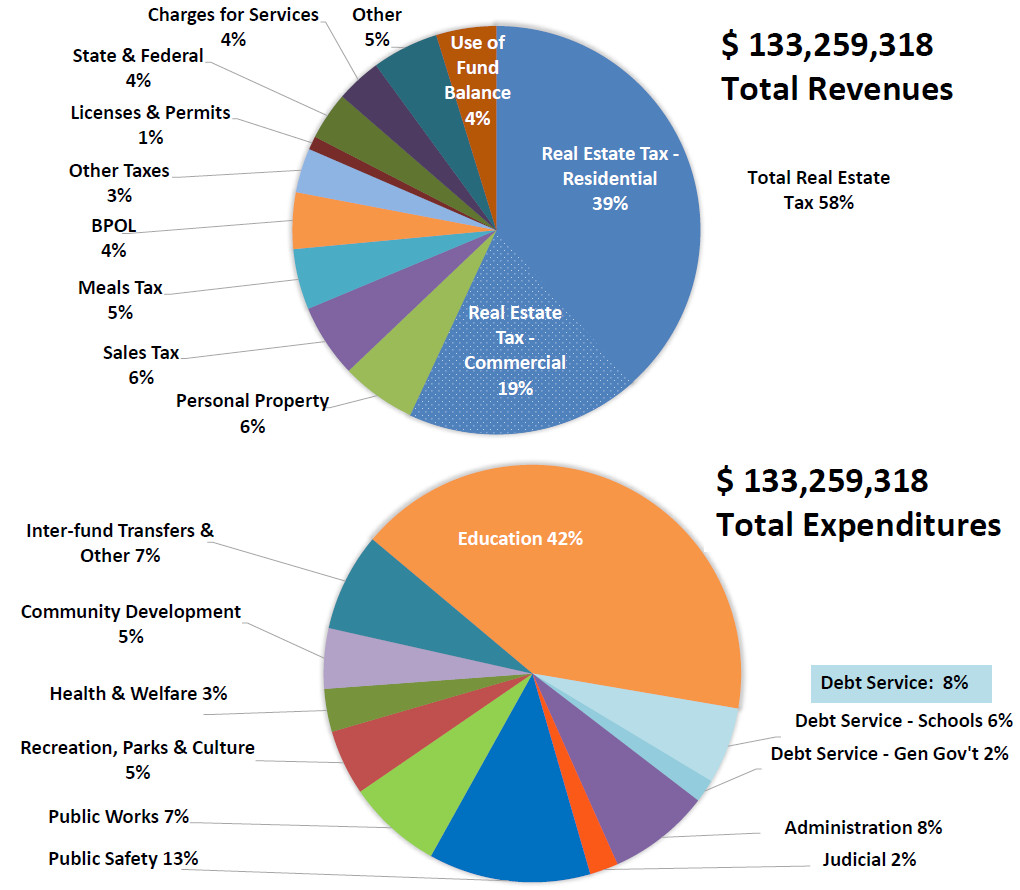

- The adopted FY2026 budget of $133,259,318 sets aside $650,000 in contingency reserves, reflecting the negative economic outlook for the next few years. $25,000 in emergency assistance funds were added for City residents.

- Chief Financial Officer Kiran Bawa announced her resignation, effective the end of June. She is returning to California. [See Pulse post, CFO Bawa Leaves Falls Church After 8 Years, May 16, 2025].

Background

The City had initially projected a healthy 6.4% growth in tax revenues, powered by a 10.5% increase in real estate assessments, that would enable a real estate tax rate reduction from $1.21 to $1.185. This budget, presented March 24, is described in our earlier post.

However, in mid-April, the Finance office revised the tax revenue projections downward by $1.2 million to an increase of 5.3%, following the collection of lower than expected local taxes in the previous months and negative economic news for Northern Virginia. Suddenly, a tax rate cut became less likely. [See the Pulse post, Flash Update: FY2026 Budget – Proposed Real Estate Tax Rate Reduction is Gone! April 11, 2025.]

At the May 5, 2025, City Council work session, discussions turned to where cuts could be made to provide some tax relief to homeowners whose property assessments had increased 6.85% on average. A slightly smaller budget was approved at the May 12, 2025, City Council meeting, enabling a penny reduction in the real estate tax rate.

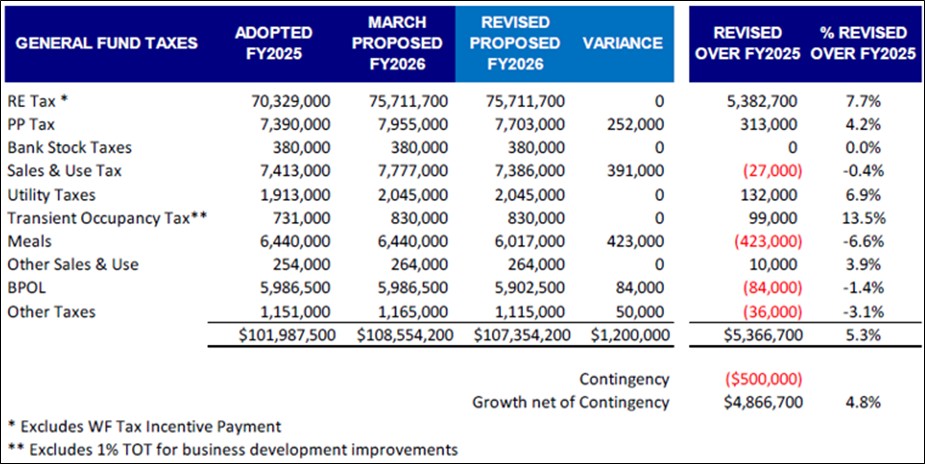

$1.2 million lower sales tax, meals tax, property, and other taxes projected

FY2026 real estate assessments were fixed in February so that the real estate tax revenues are only dependent on the real estate tax rate. However, all other local taxes are forecast based on historical data and economic conditions.

In April, staff revised their projections for business, sales, and meals taxes to levels below FY2025 as well as lower property taxes. The reductions total $1.2 million and would only allow a 0.- cent real estate tax rate reduction if the $133.9 million March budget were adopted.

The table below shows the revised tax revenues.

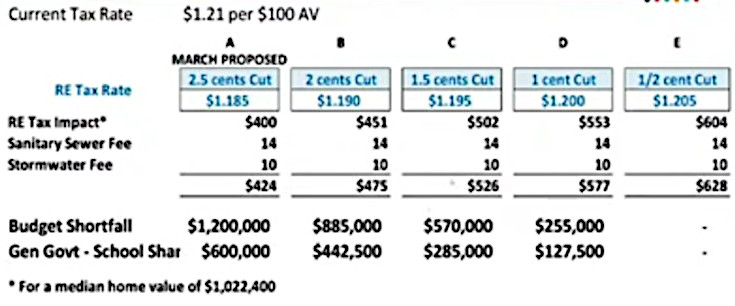

Balancing school needs, City services, and tax burden on residents

At the May 5, 2025, City Council work session, City Manager Wyatt Shields presented City Council with the table below that illustrates how much the March budget would need to be reduced to achieve different real estate tax rate cuts.

A penny is equivalent to about $630K in real estate taxes. A penny cut would require a reduction of $255K in the March budget, equally shared between the schools and the general government under their revenue sharing agreement. [See previous budget post.] The real estate taxes on the median homeowner would increase by $553 (4.7%). Together with the 2.7% increase in the sanitary sewer fee and the stormwater fee, the total increase in payments would be $577. (All other tax rates are unchanged.)

Although Mr. Shields was able to offer a plan to achieve a 1.5 cent tax rate cut, i.e. with a $285,000 budget cut, the School Board was only able to offer a $145,000 reduction in its budget. Enrollment is projected to increase by 150 students next year.

The City Council accepted the School Board’s offer to cut the City’s transfer to the School Board by $145,000. Mr. Shields agreed to reduce the general government budget by $261,000 by:

- Not replacing the Community Planning and Economic Development Services (CPEDS) director, Jim Snyder, who retired in January 2025 – $210,000.

- Eliminating Watch Night as it has had mixed success in drawing people – $30,000.

- Canceling a contract for onboarding new hires – $16,250.

- Eliminating the purchase of Renewable Energy Credits. Instead, the City is installing solar panels on Aurora House – $13,000.

- Increasing the funds for emergency assistance to residents for rent, utility bills, food, etc. – ($8,250)

The adopted FY2026 operating budget

The table below summarizes the final operating budget. The 3.2% decrease in the total budget is due to a $10 million reduction in spending for the Capital Improvements Program (CIP) and $1.8 million decrease in debt service. FY2025 was unusual in that the City was drawing down reserves accumulated for a number of capital projects. The general government budget grows by 6.3%, and the City’s contribution to the school budget grows by 5.3%. These differences mean that benchmarking the topline budget growth/decrease across neighboring jurisdictions is not informative.

Contingencies for stormy times ahead

The University of Virginia’s Weldon Cooper Center has projected that the unemployment rate in Virginia will rise from 3.2% to 3.9% by the end of 2025 and to 4.7% in 2026. The impact of the federal workforce reductions will be more apparent by October as many laid-off employees are being paid through September.

The FY2026 budget includes the following contingencies:

- Revenue Contingency ($535,000) – to cover any tax revenue shortfalls

- Expenditure Contingency ($115,000) – This includes an increase to the tax relief for seniors. It also provides a cushion for spending this year or next.

- Emergency Assistance ($25,000) – Funds to help residents with emergency rent payments, utility bills, food, etc.

Some City residents questioned the need for the different contingencies that together add up to a penny of real estate taxes. Mr. Shields and Council members agreed that having the contingencies would provide the buffer needed for the economic uncertainties ahead. Mr. Shields and Chief Financial Officer Kiran Bawa added that the City needs to be mindful of its cash reserves to maintain its AAA credit rating for the sewer bond issuance next year.

Ms. Bawa also said that the City is projected to end FY2025 with a budget surplus, making additional funds available to be reallocated or put into reserves. FY2024 ended with a $6 million surplus. [See the Pulse post City Council Review Options for the $6 Million FY2024 Budget Surplus, November 6, 2024.

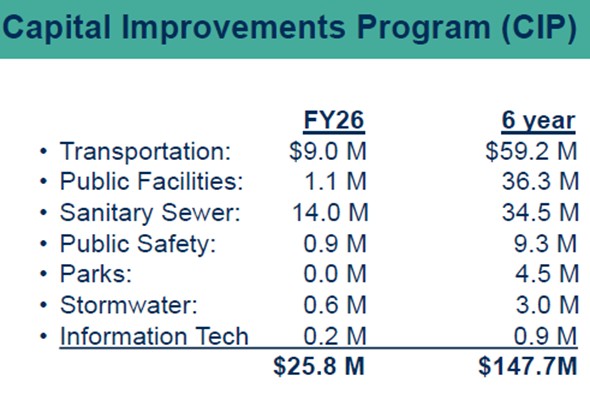

Changes to the proposed FY2026 CIP

- The Aurora House Rooftop Solar project will now be funded for $104,000.

- Crossman Park will not get a new playground, and the playground for Cavalier Trail Park will be funded from savings on other Parks and Recreation projects, removing $495,000 from the CIP.

Otherwise, the FY2026 CIP is as reported in the earlier Pulse post, FY2026-2031 CIP Budget – Major Sewer Infrastructure Project to Begin Soon, April 16, 2025. The adopted FY2026-2031 CIP plan is $147.7 million with $26.2 million to be expended in FY2026, summarized in the table.

Will the City and the School Board continue revenue sharing?

The 50-50 tax revenue sharing agreement between the schools and the general government budgets had to be abandoned in this budget. This also happened during the COVID years when tax revenues were low while the school needs remained unchanged. In FY2026, the City’s growth resulted in a projected increase of 150 students at a time when an economic downturn is in view. Clearly, a significant reduction in the school budget would be consequential.

As Mayor Letty Hardi said, “[Revenue sharing] has worked well in good times.” It has worked less well in bad times, although it is unclear what the replacement should be. The City is loath to go back to the days when the School Board and the City fought over funding.

A possible tax rate reduction in three months from trash pick-up fees

Deputy City Manager Andy Young will lead a task force to study how the City could convert to charging homeowners a fee for trash pickup instead of paying for solid waste collection from general taxes. This change will not affect the budget size, although it will result in higher payments by homeowners for City services. A tax rate reduction will be implemented that is equal to the trash fees generated, currently expected to be 1.5 cents.

Mr. Snyder sums up the FY2026 budget

Council Member David Snyder provided an apt summary of the FY2026 budget:

“By every reasonable expert prediction, we have some very serious and difficult years ahead. This budget is our first effort to try to get ahead of that in two ways. First of all, by providing the one-cent return – and there’s no question that we’d all like to do more. But every bit as important is providing for the contingencies that may be the difference between our government continuing to function and one having the difficulty of providing even basic services or support for education …. I think this budget does a pretty good job of balancing all of those [needs] under trying circumstances.”

A heavier tax burden on homeowners than commercial property owners

For FY2026, increases in residential assessments accounted for a whopping 80% of the total $5.4 million real estate tax increase, despite the addition of Founders Row, Broad and Washington, and the West Falls properties. The average residential assessment increased 6.85% while the existing commercial property assessments increased only 2.37%.

Residential real estate accounts for 38% of all budget revenues, and these assessments have increased in good times and bad, placing a heavy burden on longtime homeowners and forcing many out of the City once their children graduate high school. The City provides tax relief for low-income seniors, but many others do not qualify. (Housing and Human Services reported that they recently received requests for help from laid-off federal workers but were unable to help because these citizens failed the income and asset test despite needing financial assistance.)

The table below shows how the median home value, based on assessments, has changed in the last five years. It also shows how the real estate taxes grew each year despite a falling real estate tax rate and continued development.

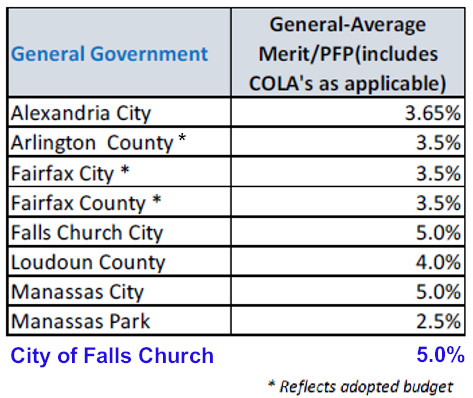

Comparison of employee compensation increases

The $3.4 million increase in general government operating budget includes $2.1 million for a 5% increase in employee compensation. Below is the comparison with neighboring jurisdictions for FY2026.

Adopted FY2026: General Fund Revenues and Expenditures

References

- City Budget & Capital Projects Webpage. Falls Church, VA – Official Website.

- Capital Improvements Program (CIP) | Falls Church, VA – Official Website.

- City Manager’s FY2026 Budget Adoption Presentation 5/12/2025.

- FY2026 Proposed Budget & CIP Ordinance, May 12, 2025.

- FY2026 Budget Question &Answers #6, May 12, 2025.

- City Council Work Session, May 12, 2025. This official video will not display properly on a small screen as it includes the agenda.

- City Council Meeting, May 12, 2025. YouTube video.

- City Council Work Session, May 5, 2025. YouTube video.

- City Council Work Session, May 5, 2025. This official video will not display properly on a small screen as it includes the agenda.