FY2025 Budget Adopted After Squeezing Another Penny Off The Tax Rate

Summary

- The City Council asked for an alternative budget with another penny reduction in the real estate tax rate and on May 13, 2024, voted 6-1 to adopt this alternate budget for a final tax rate of $1.21 per $100 of assessed real estate property value.

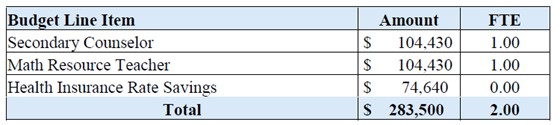

- In the budget adopted, the School Board absorbed a cut of $283,500 to the proposed transfer from the City, and the general government reduced its operating budget by the same amount, in keeping with their revenue sharing agreement.

- The School Board made up the difference by using their reserves.

- The general government removed two new positions and partially charged another to the Capital Improvements Program (CIP) fund.

- Initially, Mary Riley Public Library’s request for staffing was going to be cut, but it ultimately survived, enabling weekend hours to be extended.

- The City Council was surprised that the Police Department had not regained accreditation. They stressed to the City Manager that accreditation remains a top priority for them.

Background

The City Council asked City Manager Wyatt Shields to provide an alternative budget that incorporated a real estate tax rate of $1.21 instead of the $1.22 proposed. At the City Council work session on April 29, 2024, Mr. Shields presented proposed cuts to the School and City budgets that would allow for this tax rate reduction. Further discussion ensued at the May 6 work session as it appeared that the majority of City Council members were in favor of the slimmer budget. On May 13, City Council voted to approve the budget with the $1.21 tax rate.

The Pulse posts, A Review of the Proposed FY 2025 Budget and The Capital Improvement Program (CIP) 2025 and Beyond, provide brief explanations and descriptions of the City’s operating budget and the capital expense budget. These posts describe the original budgets proposed on April 1,2024.

What does another penny off the tax rate mean?

A lower tax rate does not necessarily lead to lower real estate taxes. The actual taxes paid also depend on the assessed property value. In fact, when the assessed value increases because of a strong real estate market, local governments tend to reduce the tax rate to moderate the amount of taxes collected. Conversely, when the real estate market falls, tax rates may be increased to ensure that sufficient taxes are collected.

In 2024, the average homeowner’s assessment rose by 3.2%. This means that a reduction in the tax rate from $1.23 to $1.22 per $100 of assessed value would result in the real estate property tax increasing an average of 2.4%. With the rate further reduced to $1.21, homeowners will see an average tax increase of 1.6%. If all real estate taxes were to remain the same as in the 2024 budget, the tax rate would have to fall to $1.18.

The originally proposed $138.3 million budget already allowed for a tax rate of $1.22. Another penny reduction in the tax rate meant that this budget had to be reduced by $567,000 to $137.8 million. As per the revenue sharing agreement with the School Board, half of this reduction ($283, 500) would be borne by the schools in a reduction to the funds transferred to the schools, and half by the City’s general government.

Support for a further reduced tax rate

Council Member Erin Flynn said that she had heard from many people who told her that they were burdened by the real estate taxes, and “they’re getting marginally increased sewer fees, marginally increased storm water fees, and they’re paying more every week just because of inflation costs right now, and so I support trying to go down those two cents for that reason.”

Council Member Marybeth Connelly, who had missed the April 29 meeting, said that she was surprised that her colleagues were in support of the penny cut. She was concerned that revising the budget amounts at this time might jeopardize the revenue sharing agreement with the School Board that had been in place since the FY 2020 budget. That agreement provides the School Board with budget guidance in December to allow for a smooth budgeting process. She was concerned that if this agreement broke down, the City would revert to the stressful negotiations of the past. (Ms. Connelly is also an employee of the Falls Church City Schools.)

At the School Board’s May 13, 2024 meeting, School Board Vice Chair Kathleen Tysse told the City Council that she and her colleagues were surprised to be told of the cut at such a late date, in late April. Because a May 10 budget and finance meeting was cancelled, “there was no opportunity to publicly discuss” this cut, Ms. Tysse said.

Vice Mayor Debora Schantz-Hiscott responded that there had been discussions about whether the penny tax rate reduction was sufficient “for our residents who’ve seen so much change and so much growth and are expecting to have some personal dividend from that growth.”

Mayor Letti Hardi spoke of her concern for the overall budget growth. The general government expenses grew by 8.8% over 2024 to $52.2 million. She said, “I think we just need to understand what a reasonable pace of government growth should be which is why you are hearing us push to find an additional penny.”

Council Member David Snyder said that the budget covers more than the essentials and provides “fair treatment of employees in both City and the Schools.” His goal is that “we are not taking more than we need from our citizens who are the taxpayers.”

The School Board offered up “cuts”.

The School Board summarized their plan for how they would cope with a $283,500 reduction in the amount the City would transfer to the School Board Fund in the table above. (One FTE is the equivalent of one full-time employee.) The salaries for the counselor and resource teacher will be covered by reserves in the fund as one-time charges to cover these positions for one year. The actual health insurance rate was less than what was budgeted in December, providing the remainder of the cut.

Shaving the general government operating budget by $283,500

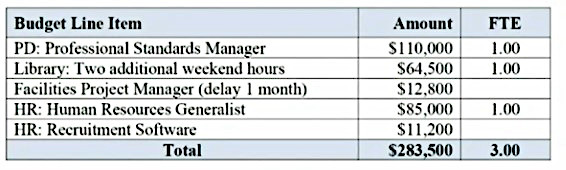

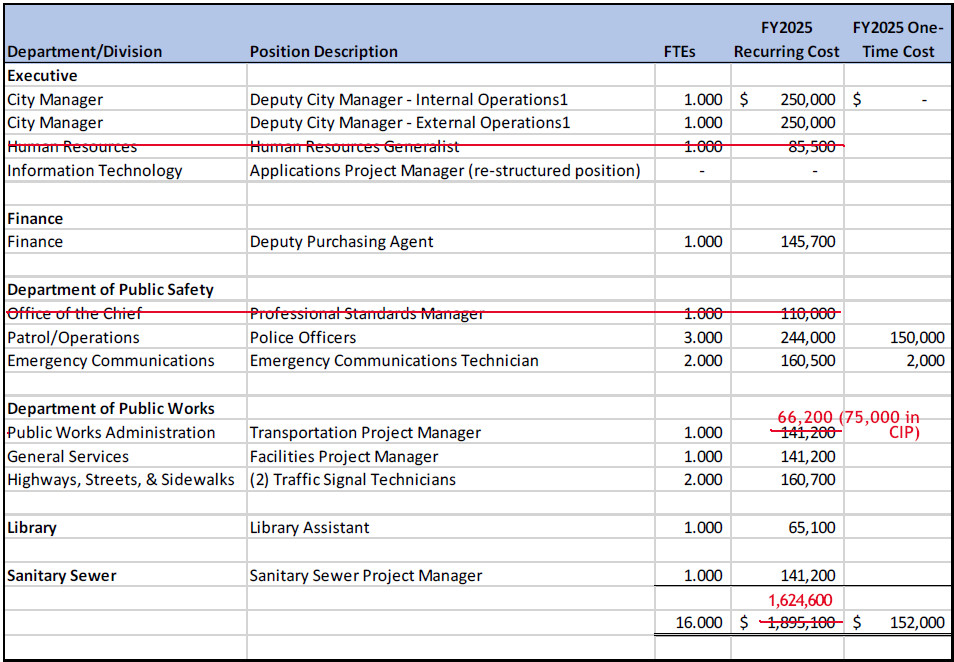

Unlike the School Board that was able to adjust for the reduced transfer amount by drawing more from reserves, Mr.Shields had to reduce the $52.2 million general government operating budget by $283,500. At the April 29th meeting, he put forward the plan shown in the table.

The Department of Public Safety (DPS) would not hire a professional standards manager for the Police Department. The Library would lose its request for two 0.5 FTEs and the Human Resources Department (HR) would not get its generalist who would allow HR to implement a recruitment software module.

Council protests the proposed library cuts.

Deputy City manager Jenny Carroll confirmed that the library staffing cuts would mean that the proposed extension of the weekend hours at the library would no longer be possible. Ms. Flynn maintained that the library is an important facility for residents and, given the investment to renovate the library, the City should make it available as much as possible. Also, with the coming months-long closure of the Community Center for the HVAC replacement, she argued it would be even more important to have the library available as a public gathering place.

Ms. Flynn wondered why the library had been given such low priority that it was cut. As an example, she said that the Office of Communication had a 179% increase in its services budget item from $36,000 to $101,000. She said, “So you are prioritizing that over the library?” She asked if some of the money could be directed to the library, including the $15,000 for advertising in local newspapers (presumably, The Falls Church New-Press).

Council Member Caroline Lian supported her, saying “We’re only talking about $64,000.” Ms. Lian was in favor of finding money elsewhere instead of the library. She suggested that staff look at funding items from the Capital Improvements Program (CIP) instead of the operating budget.

Mr. Shields removes the library from the chopping block.

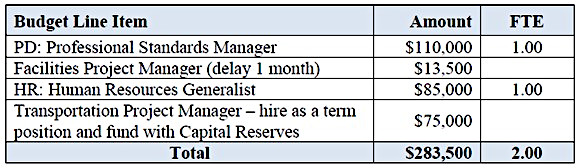

At the next work session on May 6, Mr. Shields presented a revised plan of cuts that did not include the library. This new proposal takes up Ms. Lian’s suggestion, transferring a portion of the cost of the transportation manager to the CIP so that it is now accounted for in the CIP budget instead of the operating budget.

Source: FY 2025 Budget Q&A document

Police department’s lack of accreditation is a surprise.

At the May 6th meeting, Council members asked Mr. Shields about the impact of not having the professional standards manager on the police staff. This person was to work on policies, procedures, and documentation for accreditation, a job that is currently being handled on a part-time basis. DPS will still have five new positions and a total budget increase of over 9%. In addition, two new Deputy City managers are being hired in the City Manager’s executive office that oversees DPS.

Council Member Snyder said, “We lost police accreditation once, and it was an embarrassment. I‘ve got to]say that’s a very high priority for me and I want assurances that management is going to get it done.” He added, “I do want to get to the two cents [tax cut] and I don’t see why we have to hire somebody else to do it, considering how we’ve expanded the number of employees both in the Police Department and general government.”

Mr. Shield then surprised Council members when he said, “We are currently out of accreditation.” Council members thought the issue was maintaining accreditation, not regaining accreditation.

Mr. Snyder said, “Frankly, [that’s] not a satisfactory response from management. I mean you are talking about approving a huge budget with major new employees, and for management to come back and say ‘Well, we can’t do that. We’re just not going to be able to move as rapidly as we should on accreditation because you’re not giving us $100,000 for accreditation’.” He pressed Mr. Shields to study the issue and return with a plan for accreditation at the next meeting.

Councilmember Justine Underhill asked why accreditation was needed as the police seemed to be functioning well as it is.

Mr. Shield responded, “We want it. Absolutely.” Accreditation is determined by an independent body that audits the department’s policies and procedures for proof of compliance with best practice. He said, “Policies are the heart and soul of any public safety agency.” Ms. Flynn explained that accreditation provides assurance that the Police Department is keeping records that are needed to “make sure that you have an accountable police force.”

At the May 13 meeting, Mr. Shields reiterated that accreditation would take time. Ms. Lian asked for regular updates to the Council on this topic, and Mr. Snyder said that the Council would find additional funding during the year for accreditation, if necessary.

Items removed from the CIP

Council members asked for three items to be removed from the six-year CIP, the capital expense budget.

- Incorporate the Police Evidence Garage in the Property Yard project (FY2026, $300K)

- Remove the City Hall Annex Fitout (FY2025, $375K)

- Remove the Kaiser elevator (unfunded $700K)

FY2025 budget adopted

The City Council voted to adopt this slightly smaller budget at its May 13, 2024, meeting. The vote was 6–1, with Ms. Connelly voting against it. All other budget ordinances covering the tax rate and increases in the stormwater and sewer utility rates passed unanimously.

References

- City Council work session April 29, 2024. YouTube video.

- City Council meeting, April 29, 2024. This official video will not display properly on a small screen as it includes the agenda.

- City Council work session May 6, 2024, YouTube video.

- City Council meeting, May 6, 2024. This official video will not display properly on a small screen as it includes the agenda.

- City Council meeting, May 13, 2024. YouTube video.

- City Council meeting, May 13, 2024. This official video will not display properly on a small screen as it includes the agenda.

- Budget Q&A #5

- FY2025 Proposed Budget & CIP Ordinance