FY2026 Budget Guidance For Falls Church City Expects 5.5-6% Revenue Growth Yet Projects $2 Million Shortfall

Summary

- The City Council on December 9, 2024, voted unanimously to approve budget guidance to the general government and the school division for Fiscal Year 2026. The draft guidance avoids specifying a target tax rate in light of the uncertainties associated with the incoming federal administration, state aid from Virginia for the schools, and the impact of the City’s growth on infrastructure, including student enrollment.

- The Washington, DC metropolitan region is struggling economically; however, within this regional context, Falls Church City is growing revenue at a rate of 5.5-6.0%. New tax revenues projected for FY2026 totals $5.9 million, half of which will come from new developments.

- With healthy revenue growth come increased costs for infrastructure, including the City’s schools. Anticipated expenditures for the City and its school division in the fiscal year ahead are currently expected to produce a $2 million revenue gap. This news follows a surplus at the end of FY2024 of $6 million.

Budget guidance adopted

Acknowledging a series of unknowns – from the employment and agency relocation actions the incoming federal administration may take to the impact of the City’s growth on costs, the City Council adopted amended budget guidance for FY2026 at its December 9, 2024, meeting. Council Member Marybeth Connelly proposed the amendment to avoid specifying a tax rate, and, after some wordsmithing, the Council voted unanimously to approve it and the budget guidance overall.

The amendment reads: “In light of projected growth in assessed value of real estate and its associated financial burden on homeowners, the Council desires to hold steady or reduce the tax rate but is also aware that in order to meet core government and public education needs, a tax rate increase may be required. Throughout the budget process, the Council will endeavor to determine the appropriate tax rate to match the core government and public education needs of the community and may consider setting aside tax revenues for contingencies. The Council and the School Board will remain in continual contact.”

City Manager Wyatt Shields described the document as “a framework” that he and his staff and the School Board and Superintendent Dr. Peter Noonan will use to formulate their respective budgets. Mr. Shields said that such guidance has been issued by the Council annually for the last decade.

The 11-point guidance includes the intention to “continue the spirit of cooperation and collaboration between the General Government and the Schools in the development of the annual Budget and Capital Improvements Program.” It seeks to “ensure compensation for employees, provide funding for professional development and training, and foster initiatives to promote retention and recruitment.”

The guidance further directs that initiatives implemented in the last fiscal year, including such infrastructure maintenance as paving and sidewalk improvements and walking, biking, and other means of mobility be funded and delivered. It calls for sufficient funding for tax relief programs along with policy recommendations to ensure that these programs are adjusted for inflation, continued rent and food assistance for low-income families, options to increase ongoing funding for affordable housing, and public safety and emergency management in a rapidly growing community.

The guidance requires funding to implement the recommended actions in the Community and Government Operations Energy Action Plans to reduce greenhouse gas emissions. It also specifies that the utility fund budget provide a plan to finance additional sanitary sewer capacity to address the growth expected from new developments and to mitigate rainfall-induced inflow and infiltration into the collection system as called for in the proposed capacity purchase agreement with Fairfax County.

Lastly, with this guidance, the Council asks that the City Manager calculate and highlight in the budget presentation the pension expense avoided by the investment of a portion of the water sales proceeds in the pension fund, solicit public participation and input in budget decisions, and explain the FY2026 budget clearly.

Joint City Council – School Board meeting

A week before its December 9 vote on budget guidance, the City Council held its annual joint budget meeting with the Falls Church School Board. City Manager Shields and Chief Financial Officer Kiran Bawa shared the general government’s FY2025 revenue for the first quarter and revenue and expense forecasts for FY2026.

Superintendent Dr. Noonan also reviewed the school division’s enrollment projections and resource needs for the 2025-2026 school year. [See Pulse post, School Growth Leads to Possible 9.4% Increase in FCCPS FY2026 Budget Request, December 16, 2024.]

(The source for all the charts that follow is the City’s FY2026 Financial Forecast presentation given during the School Board/City Council Joint Meeting, December 2, 2024.)

Healthy revenues; greater costs

Mr. Shields began the City’s presentation by noting that the metropolitan region is struggling economically; however, within that regional context, Falls Church City is growing revenue at a rate of 5.5-6.0%. “With that healthy revenue growth our costs are higher than the economy is providing for us,” he added, noting that it appears from initial general government and more detailed school projections that budget planners will need to address a $2 million gap between revenues and expenditures.

This news comes on the heels of the City Council’s allocation last month of a $6 million surplus for FY2024 and $8.4 million in income from the sale of the Grad Center site a year ago. [See Pulse posts, The FY2024 Year-End Financial Report – a $6 Million Surplus!, November 4, 2024; City Council Reviews Options for the $6 Million FY2024 Budget Surplus, November 6, 2024; and Why the “Grad Center” Site Was Bought, Leased, and Sold by the City, December 12, 2024.]

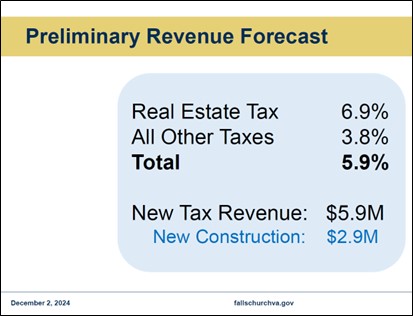

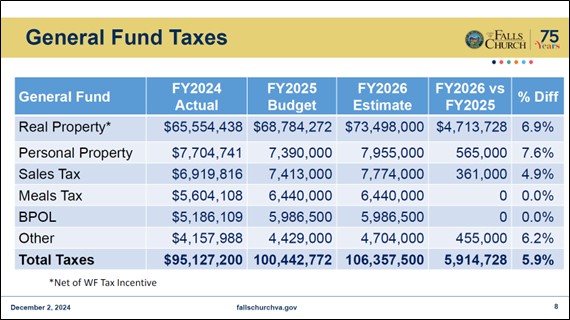

Just at the beginning of planning for the next fiscal year, Ms. Bawa provided a preliminary revenue forecast shown in the chart below, noting that overall real estate taxes are projected to grow at 6.9% while all other taxes are estimated to expand by 3.8%. In addition, she said, half of the new tax revenues of $5.9 million is being generated by new construction. Under their revenue sharing agreement, this new revenue will be split 50-50 between the general government and the schools for $2.95 million each. “For the schools, this translates to [a] 5.6% [increase],” Ms. Bawa said.

Higher real estate tax revenues

Real estate taxes constitute 60% of the City’s revenues. Overall, total real estate assessed value (AV) has increased 7.8% year over year. Ms. Bawa estimates that the FY2026 tax bill for the homeowner with a median-priced home at $1,011,800 will increase by $529 for the year.

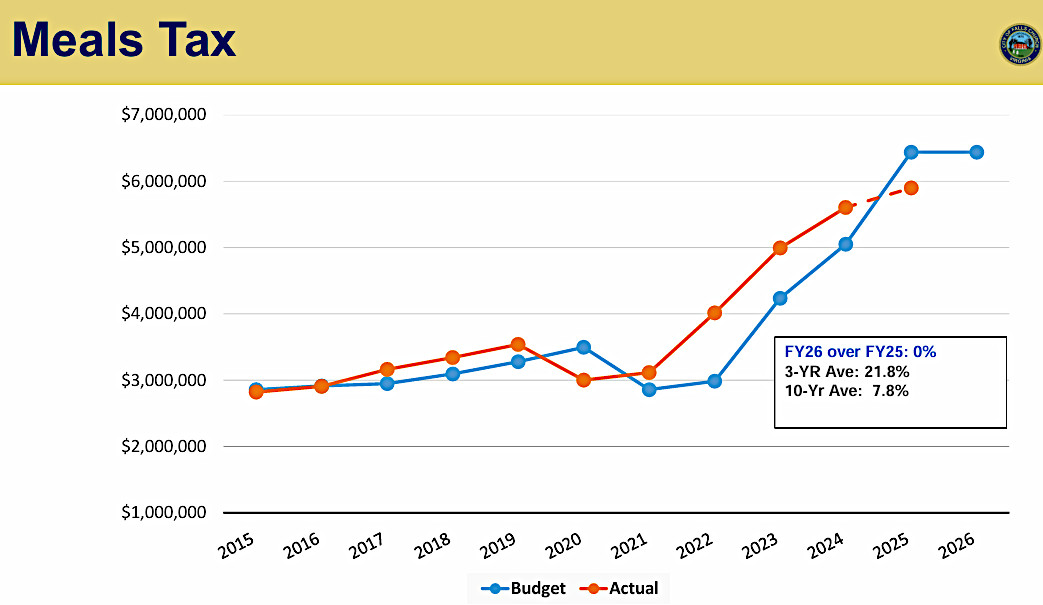

Lower meals and business license taxes

Ms. Bawa offered the following summary of taxes that make up the City’s General Fund, which together are projected to increase 5.9%. “Other” taxes include hotel and recordation taxes.

Despite the increase in the number of restaurants opening in Falls Church, Ms. Bawa is currently forecasting no growth in either the meals tax or business licenses (BPOL). In fact, the actual meals taxes collected in the first quarter of FY2025 were lower than expected. “Absent new developments, this could have been a drop [in revenue],” Ms. Bawa said. Mr. Shields added, “We are seeing some reduction in tax receipts from our existing restaurant base; that is being offset in the sector that’s associated with new restaurants opening up, and the Whole Foods is going to pay a lot of meals taxes.”

Cost drivers for City’s General Government

Ms. Bawa identified the cost drivers for the general government in the chart below. These drivers include compensation and benefits, positions originally funded by the American Rescue Plan Act (ARPA) that the City now hopes to make permanent, and Washington Metropolitan Area Transit Authority (WMATA) and interjurisdictional (IJ) contracts. These numbers do not include any other new positions, new initiatives, or expanded services, she said.

The $2 million budget gap

Adding the general government’s increased revenue requirement of $2.94 million to the schools’ additional expenditures of $4.96 million for a total of $7.91 million in new expenditures against new revenue of $5.9 million produces the $2 million shortfall for FY2026 shown below.

Budget schedule

City Manager Shields and the School Board will present their proposed budgets to the City Council on March 24, 2025. Public hearings and town halls will be held in April and May. The City Council is currently slated to adopt the FY2026 budget on May 12. The fiscal year begins July 1, 2025.

References

- City Council Regular Meeting, December 9, 2024. This official video will not display properly on a small screen as it includes the agenda. The budget discussion begins at timestamp 1:14:53 and ends at 2:20:00.

- City Council Regular Meeting, December 9, 2024. YouTube video.

- City Council Joint Meeting with the School Board, December 2, 2024. This official video will not display properly on a small screen as it includes the agenda. The entire budget discussion begins at timestamp 0:08:06 and ends at 2:10:55.

- City Council Joint Meeting with the School Board, December 2, 2024. YouTube video.

- FY2026 Budget Planning Session Report.

- FY2026 Preliminary Revenue Forecast as of 12-02-24.

- West Falls Project Lease Terms.

- West Falls Financials Summary.